A Recession is Coming! So What...

“The stock market has predicted nine of the past five recessions.” - Paul Samuelson

What does a recession even mean?

The technical definition is as follows:

“An economic recession is a period of significant and broad-based decline in economic activity that lasts for months or even years. For example, the COVID-19 pandemic created an economic shock that caused a brief recession in early 20201

The definition itself is broad, every recession is different, and we won’t know if we experienced one until the National Bureau of Economic Research makes their official announcement.

But what do we know?

There have been 10 official recessions since the S&P 500 was created in 1957.

Yet the index is up roughly 800% since then.

We’ve done this before and recessions will certainly happen again.

If we are headed towards one, this has to be one of the most anticipated recessions.

Everyone and their mother is predicting that we are either in a recession or will experience one in 2023.

We can’t deny that we are seeing some indicators that might hint at an upcoming recession:

We had two consecutive quarters of negative GDP (Q1 & Q2 2022)

The Conference Board Leading Economic Index signaling an elevated likelihood of recession

Flattening/Inverted US Treasury Yield Curve

Weakening Consumer Sentiment

But Economists and investors alike are almost certain. But what have I told you about financial and economic forecasting?

IT’S A FOOLS GAME. NONE OF THEM KNOW.

When you hear recession, we often become scared. The media capitalizes on these moments to get the clicks they need.

But for a goal-focused, long-term investor, you shouldn’t be phased.

Here is why:

Stocks don’t always decline during recessions as this chart points out:

The economy is not the stock market. Markets are forward looking. Meaning, the stock market could have already declined significantly before a recession is officially declared.

Yes, the stock market takes a hit when economic activity slows down.

And I’m empathetic for the individuals who lose their jobs during an economic slowdown.

But for investors, there are reasons to be optimistic.

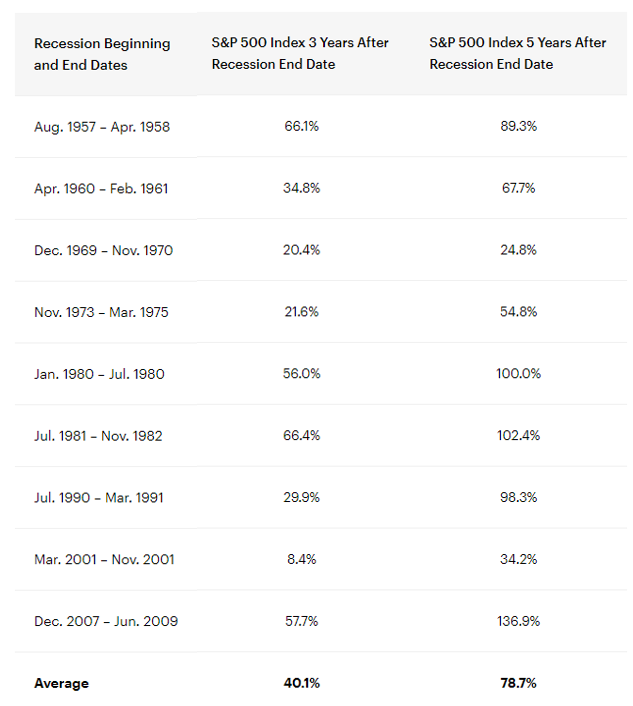

How do the markets perform after these recessions?

Pretty damn good:

Pay attention to the 3- and 5-year returns after the recession is over:2

Takeaway? Recessions are part of the game and the markets have bounced back significantly after every recession we’ve had.

We have built portfolios that are meant to handle the good times and the bad times.

Why would I change my strategy based on an event that I know is inevitable? It’s part of the market cycles.

Also, did you know that great companies and individual success stories tend to be created during these times?

Microsoft, Uber, Instagram, Square, and Airbnb are just some of the companies that were created during a recession.

We won’t know how long this lasts, the severity of the contraction, or where valuations will end up.

But what we do know is that we will get through this.

So, for those that are able to stick to their plan, stay rational, and control what they can control - you will be rewarded.

I love this graphic that was recently posted:3

If you or someone you know is struggling, please reach out to me!

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.

Source: “Business Cycle Dating Procedure: Frequently Asked Questions,” National Bureau of Economic Research (NBER), (August 2022).

Source: Bloomberg, 6/13/22. As represented by the S&P 500 Index.

https://ritholtz.com/2022/09/what-is-in-your-control/