Don't Listen to the Media, There Are Plenty of Reasons to be Optimistic

Maybe this is my own recency bias, but that past few years have felt like an absolute roller coaster.

Feel like we all are on the edge of our seats awaiting the next big crisis or event. The media has so much in their arsenal that contributes to our fears and doubts. Ff it bleeds, it leads.

I’m not saying to ignore the risks out there, we should always be mindful of those. But it’s the events and risks that no one is talking about that will actually matter.

All of this can be exhausting. That’s why I prefer to be a optimistic realist. I try to see the good in things while also not being naive.

Don’t lose sight of where we are headed and all the good that is taking place in the world:

Reasons to be optimistic:

Inflation Continues to Ease:

Annual wholesale price inflation has returned to pre-COVID levels:

A good sign that the post-pandemic price surge really is over with.

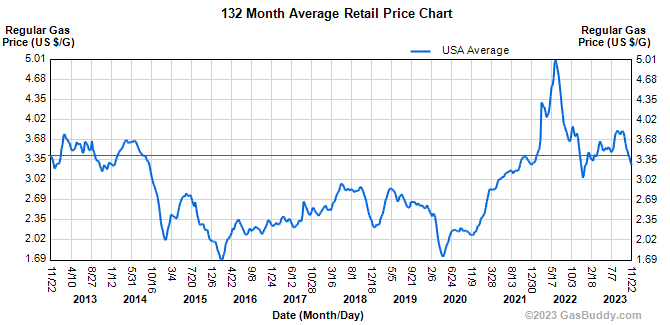

US gas prices are now below where they were on Thanksgiving 2012:

Source

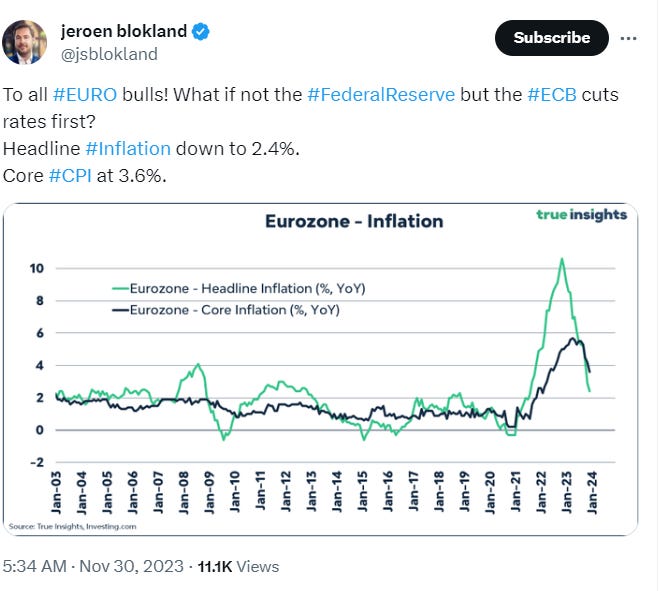

Inflation coming down across the pond as well:

Not Just 7 Stocks Driving the Market:

All year we have heard that it’s the ‘Magnificent Seven’ and that’s it. While the returns in those seven names have been extraordinary, we are starting to see solid market breadth:

Again, more than just seven names having a great year:

Michael Batnick had a great post here. The media has been talking about this non-stop but, to Michael’s point, if you zoom out sightly, it’s not that absurd:

An equal-weighted mag 7 portfolio had a 48% drawdown in 2022 that bottomed two days before the new year. So not to take anything away from the impressive run, but you can’t talk about 2023 without looking at 2022. Over the last two years, the magnificent 7 has barely beaten the S&P 500.

Consumers Continue to Power Through:

A majority of individuals locked in low-interest rate debt so they are less impacted by the large increases in rates. To go a step further, for those that have low debt, or locked in debt at low rates, you welcome these higher rates so you can now earn a real return on cash.

Take advantage of the high yield savings accounts, Treasury bills or CDs. If you’re not being proactive on this, then you’re leaving easy money on the table. These rates will eventually come down so take action now.

Mortgage-Free Is at an All-Time High

Almost 40% of US homeowners own their homes outright as of 2022—many of them are baby boomers who refinanced when rates were low:

Before all you start complaining that you can’t afford a home, I get it. But for many American’s, they now have a huge asset on their balance sheet without a mortgage payment. That is the ideal scenario as you head into retirement.

Not Just The Rich Getting Richer:

We are finally starting to see the lower and middle class see wage increases. We still have major wealth inequality in America but let’s hope this momentum keeps going.

Not to mention that the U.S. unemployment rate has been below 4% for 21 straight months — the longest stretch since the late-1960s.

We are also seeing that prime-age workers (those 25-54) who are employed is hovering at a 22-year high.

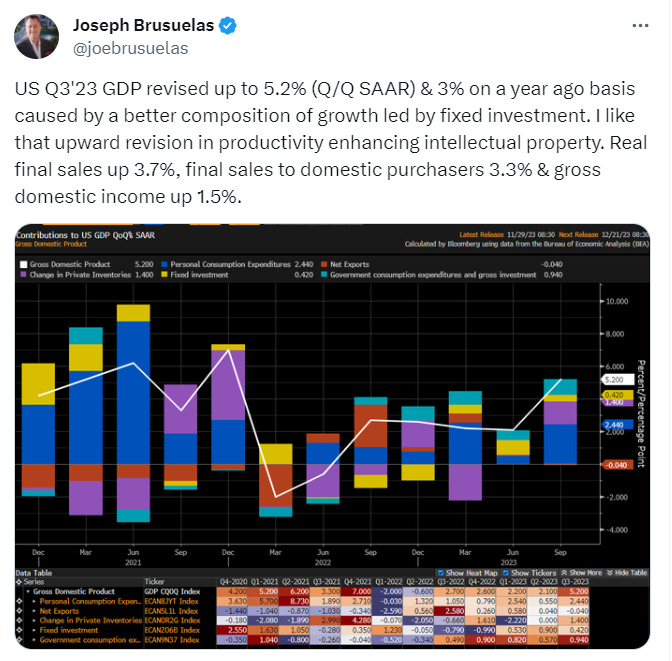

GDP continues to be strong:

One of the best recessions we have ever seen!

US Becoming Energy Independent:

US continues to become more self reliant from an energy perspective, with U.S. oil production reaching a new record high in recent weeks:

For all my climate people, I’m in your corner but this is a good thing. Educate yourself, we need oil…

Want to see what $109 Trillion looks like?

The US is home to 39 of the 100 largest companies in the world. Let’s take some pride in that but also recognize if you are solely invested in the US, plenty of opportunities in other countries as well.

Looking for more optimism? I stumbled upon a great site here which highlights all the good going on in the world.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.