Environmental, Social, and Governance (ESG) Investing - A Good Investment or Just A Marketing Scheme?

Your Beliefs Don't Always Make For Good Investments

Per the White House, “On August 16, 2022, President Biden signed the Inflation Reduction Act into law, marking the most significant action Congress has taken on clean energy and climate change in the nation’s history.”

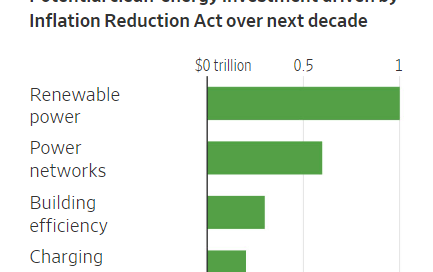

As a result, we could see close to $3 trillion in total clean-energy investments during the next decade:

If you are wondering how spending $3 trillion over a decade leads to lower inflation, so am I…

Anyway, this seems like a lucrative opportunity for investors. Your investments are benefiting from Government subsidies and investments all while you are creating a positive long-term impact on society and the environment.

Just look at First Solar ($FSLR). They are expected to receive $1 billion in annual subsidies over the next decade as a result of the Inflation Reduction Act.

The stock price soared after this news broke. (In case your wondering, I once owned this company and sold it well before the stock price skyrocketed😊, investing in individual stocks is fun!!)

This movement took the investing world by storm.

By the end of 2022, there were 600 ETFs that were considered ‘sustainable’, up 12% from 2021 and up 100% since 2019.

A Harvard study found that 75% of institutional investors consider ESG investing part of their fiduciary duty.

Larry Fink, CEO of BlackRock, which is the largest money manager in the world, even devoted his entire shareholder letter to ESG investing.

But now politicians, companies, and investors are pushing back.

Fink now refuses to even use the ‘ESG’ term as it has been tied to “woke capitalism”. You even have investment firms dropping ‘ESG’ from their ETF names because no one wants to be affiliated!

It’s become too controversial and a political baggage.

My problem with all of this has been that it’s difficult to measure, the industry has inconsistent metrics, and a lot of it is hypocritical.

We’ve seen companies use this as a compliance exercise—a set of boxes to be checked—rather than a framework to create value and do good.

At the end of the day, the higher a company’s ESG score, the more access to lending and government funding they would have. You can see the incentive companies have to adopting these measures…

Then there is the hypocrisy of all of this. Like when Tesla was kicked out of the S&P 500 ESG index but Exxon stayed in there…

Another study found that, “68% of the holdings in the mutual funds marketed with ESG standards were exactly the same as the broad based funds – yet ESG investors were paying 0.20% higher on average.”

Here you are thinking the fund is specialized and you are truly making a difference – yet you’d own the same names in the S&P 500 but you’re paying more via the ‘ESG Tax’…

I firmly believe we all want to make a difference. Just not in my backyard…

There was a story in the WSJ recently:

In Michigan, a typical solar project once covered 60 acres but now would take up 1,200, said Sarah Mills, a senior project manager at the University of Michigan’s Graham Sustainability Institute. Ms. Mills said they may need to get smaller—and more expensive—to be more socially acceptable. A refrain emerging at community meetings she attends is, “What you’re asking our rural community to host is way more than our fair share.”

It’s difficult to balance the E, S, & the G:

For example, shutting down a polluting plant helps the environment but hurts those workers and the communities they live in.

Also, there is this:

I’m a firm believer that we need to take action to preserve the environment. Some are even willing to pay more for that.

But as an investor, I’m cognizant that my beliefs may not make for the greatest investments.

So how can I make a difference? Again it comes down to the things I can control.

As a consumer, I can be aware of the products and companies that I buy from and support.

As a human being, in everyday life, I can be there for my community and ensure I’m doing my fair share to preserve the environment and frankly just being a good person helps…

Also, find charities and non-profits that resonate with you and that are making a difference.

We can utilize our investments and wealth to impact our communities and make a difference. Even if that means that I’m not 100% invested in ‘sustainable’ funds.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

All investing includes risks, including fluctuating prices and loss of principal.