How to Invest Outside the US

“This is the year for emerging markets” tends to be a running joke in the investing world.

Investing in companies outside the US has not helped your investment returns over the last decade:

What is considered an ‘international stock’ or an ‘emerging market’ stock?

It really comes down to where the company is headquartered, NOT where the company derives a majority of their business.

For example, Taiwan Semiconductors Manufacturing ($TSM) is one of the largest non-US companies in the world.

You may not recognize the name, but they manufacture the microchips that are in your iPhone.

This company is headquartered in Taiwan, and is considered a foreign company, but 65% of their revenue comes from North America. 1

By owning the S&P 500 index, you don’t have much exposure to one of the largest companies in the world (besides filling their pockets with each iPhone you buy…).

I’ve mentioned in a prior post that you should challenge yourself to own more than just the S&P 500.

As of 2002, Standard & Poor’s officially removed all foreign firms from the S&P 500 index.

US companies account for about 60% of the total world equity market value:

That may make you feel good, and, remember, about 30% of the profits for the S&P 500 companies come from overseas.

But is that enough?

The US is the largest importer of goods in the world.2

Don’t you want to have some ownership in these companies that send us all of our stuff?

Yes, the US has outperformed over the past decade or so.

But fight the recency bias.

From a pure diversification standpoint, I want to own some companies outside the US.

What if something were to happen here stateside that completely crushes our market?

We do have a strong appetite for foreign cars, imported foods, and luxury goods. Try and take advantage of that.

How do you gain exposure to non-US companies?

You may have heard or seen these acronyms tossed around:

EAFE (non-US, developed countries) = Europe, Australasia, and the Far East

FTSE (Financial Times Stock Exchange) = good measure of the performance for the UK stock market.

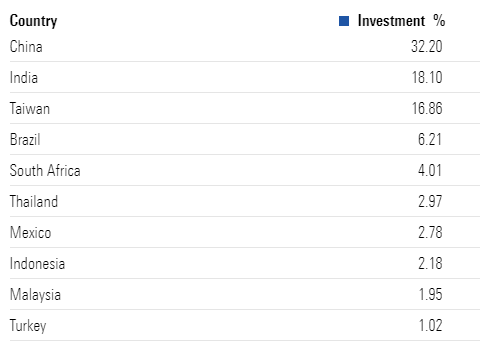

For example, if you were to look at the Vanguard FTSE Emerging Markets ETF ($VWO), this is the breakdown by country:

Are there risks investing in some of these countries? Absolutely.

China is a communist country. Their Government calls the shots and when they want something to change, change happens fast (remember Jack Ma?)

If you had money invested in Russia, safe to say those have been written down to $0.

But to have no exposure to non-US companies is a risk in and of itself.

I’m not recommending you drastically change your investments and load up on emerging markets (although some believe this COULD be their year…)

But consider allocating 10-20% of your overall assets to non-US companies.

This can potentially reduce the risk of your portfolio (if the US zigs, emerging markets may zag).

Be careful investing in a name just because the world “global” is in it.

Chances are that fund is still predominately US companies and you may become too concentrated in the big names such as Apple, Microsoft, Amazon, etc.

Here are some other ETFs that will give you exposure to companies outside the US:

EEM 0.00%↑ - iShares MSCI Emerging Markets ETF

IEMG 0.00%↑ - iShares Core MSCI Emerging Markets ETF

VEU 0.00%↑ - Vanguard FTSE All-World ex-US ETF

Assess your portfolio and see if adding some international names/funds makes sense.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001046179/000119312522104891/d204786d20f.htm

https://ustr.gov/countries-regions#:~:text=Goods%20Imports,percent%20of%20total%20goods%20imports.