I can’t help but laugh at some of these headlines.

Yes, the stock market has had a choppy start to the year, with big swings mostly to the downside.

But let’s take a step back and add some perspective. The S&P 500 was up over 20% in 2023 and 2024, the first time that’s occurred since the late-1990s.

The S&P 500 hit a record high of 6,147 on February 19th, but it’s now about 6% below that level.

The headlines above call it a ‘plunge’, I’ve heard some people refer to it as the ‘Trump crash’, so convinced that the economy is doomed.

Take a deep breath — if the year ended today, the S&P 500 would be down roughly 1% year-to-date…

These pullbacks are normal and are frankly healthy at times.

Remember one of our favorite charts (as of 1/31/2025):

The average intra-year decline is 14%, we are currently around 6%. Yet, since 1980, the market still finishes the year positive 76% of the time, and often times well over double digits…

This year’s choppiness is fairly typical for a post-election year as Ryan Detrick pointed out:

The media is loving this environment because they have your attention. They’re looking for something to blame and then use scary words like ‘crash’ or ‘plunge’, leading people to panic.

Market declines like this happen all the time — and often, they create buying opportunities in great companies.

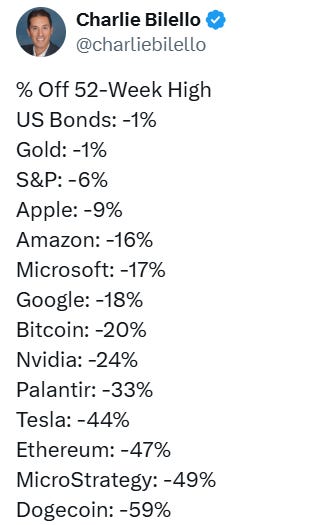

Charlie Bilello had a great post this week:

The S&P 500 is now down over 6% from its peak on February 19, the largest pullback since last August. This is the 30th correction >5% off of a high since the March 2009 low. They all seemed like the end of the world at the time.

For some, this selloff feels particularly bad because it’s in the names everyone knows:

It’s also important to remember that a healthy pullback reintroduces the element of risk. For those who think stocks only go up, this is a reminder that things can go down too, and sometimes in a hurry before you even know what’s going on.

However, diversification has been paying off to start the year. Bonds are holding up, international stocks are outperforming the U.S. market. Healthcare, financials, and energy are all performing fairly well.

Now, a lot of the selloff can be attributed to tariffs and the ongoing uncertainty. Despite the media’s surprise, tariffs were something Trump campaigned on and it was fairly clear he was going to utilize them.

But I think many people had a My Cousin Vinny moment when they actually went into effect and weren’t just a negotiating tactic…

Most of this is probably theatre and negotiating tactics and may eventually go away, who knows.

But am I selling my stocks because of this? Absolutely not…

As an investor, you can’t let political emotions drive your investment decisions. It’s crucial to focus on policies and laws that are changing, but making major moves just because you disagree with a political figure is a recipe for poor investment choices.

I really don’t think many people can handle the ups and the downs of owning stocks. They think they can and when prices are going up, it’s fun and enjoyable.

But then you get a decline or a correction and people panic. Acting off emotions and making quick decisions when often times the best course of action is nothing at all.

Be real with yourself for a second — do you really want to bet against the most profitable, innovative, and well-financed companies in the world?

Grow up.

Successful investing means building proper expectations. Volatility isn’t an anomaly — it’s the price of admission.

Know that even though stocks go up over time, it’s never in a straight line and the declines can be tough to stomach.

People want the upside of stocks but never the declines. No one complained when Palantir went up over 300% in 2024. But now that the stock is down 30-40% from the peak, everyone is wondering “whoa, what’s going on here”.

Gee, I don’t know. Could it be that the price of something actually matters? Maybe it had something to do with the stock trading at 153x forward earnings?

I don’t know, I’ll hang up and listen…

The non-stop noise and distractions will inevitably get worse.

It’s more crucial than ever to remember what actually drives markets over time — earnings.

And while everyone is currently losing their minds, things still look pretty, pretty, good.

Per FactSet.

Take a deep breath, zoom out, and remember: if you can’t handle the roller coaster, maybe investing heavily in stocks isn’t for you.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.