Is this another 2008 moment for the housing market?

The past few years in the housing market has been scorching hot.

Long lines of prospective buyers at open houses, offers coming in well above asking price, buyers having to waive inspections and add other contingencies to try and make their offers more attractive.

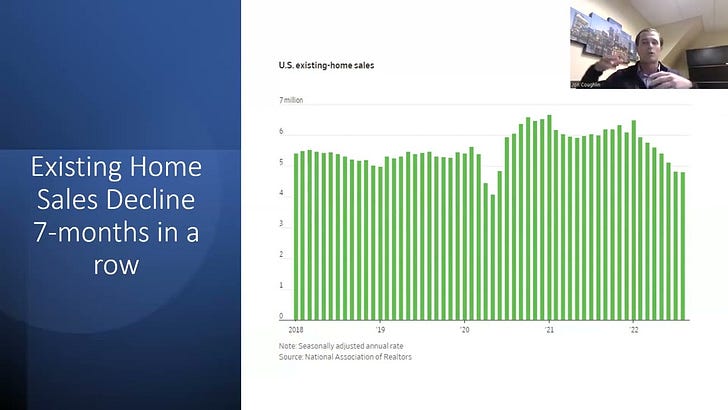

We are now starting to see some markets shift from scorching hot to frigid.

Jon and I try and make sense of what we are seeing in the housing market:

Here are some other quick housing reminders:

The best place to save for a down payment is still cash. The good news is the interest you can earn in cash and cash equivalents is now at least respectable.

We still have a housing shortage here in the US as housing inventory has not kept pace with household formations.

The 30-year fixed mortgage rate is still the most popular loan type here in the US.

You may start to hear about adjustable rate mortgages (‘ARM’). For example, if you hear about a “10/1 ARM” - this means that the interest rate on your mortgage is fixed for the first 10-years of the loan, then switches to an adjustable rate that fluctuates with the market.

Make sure you have run a ‘doomsday’ scenario before you purchase. Companies have continued to trim their workforces this year, so if you were to lose your job, ensure you have some emergency funds that can cover you for a few months while you find new work.

If you can afford to buy now, but don’t want to pay these high interest rates on your mortgage, remind yourself that you are paying 100% interest when you rent.

If you have any questions on this, please reach out!!

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.