Never Stop Investing

Humility can be so refreshing. When you have the confidence and self-awareness to admit that you were wrong or that you don’t know something, that can go a long way.

For example, Bill Ackman, a billionaire hedge fund manager, recently released a press release explaining his firms decision to sell their massive position in Netflix resulting in a $400 million loss.

I will always respect investors who admit they were wrong and take action. But one of the sentences in this press release did catch me off guard, “We require a high degree of predictability in the businesses in which we invest due to the highly concentrated nature of portfolio.”

Are you shitting me? A high degree of predictability and investing go together like my personality and the corporate auditing environment.

To me, this is one of the hardest concepts to grasp when it comes to finance and investing. There is no right answer. Yes, there are definitely approaches and ideologies that have gained wide spread adoption, are rational and history shows they work.

But in this industry, “it depends” and “I don’t know”, will always win.

This can be so hard for investors to grasp, especially when we are coming off years of insane growth. In 2020 and for most of 2021, it was almost impossible to find a stock or sector that wasn’t performing well.

Everyone and their grandmother wanted to invest and had success doing so. We were able to enjoy about a decade of free money, quantitative easing, and zero interest-rates.

Earnings for these companies were good during the pandemic, but they weren’t THAT good to justify some of these valuations.

Now its not as fun. Investors are starting to realize they don’t want to buy a company that is trading at 70x sales. Many of the gains investors experienced in the prior year are evaporating faster than CNN+.

It’s humbling to see how fast sentiment and tastes shift. We went from a period where you could do no wrong. Now? People are so convinced we are going to experience a recession and the world may be ending. It’s comical that people can act with such certainty when in reality no one really knows.

But bad news will always make good copy.

I can’t deny the fact that this is a tough market and, frankly, it’s ok to be confused right now.

The standard 60/40 (stocks to bonds) portfolio is off to one of the worst starts since 1942. We are seeing headwinds that can rattle even the most seasoned investors: Inflation, Ukraine/Russia, China Lockdowns, upcoming Mid-Term elections, potential food shortages, yield-curve inversion, Musk potentially buying twitter (kidding), etc. etc.

Markets do not like uncertainty.

Periods like these can remind investors the importance of diversifying. Blend, blend, blend.

It may surprise some investors that there are other sectors/industries to invest in other than big tech. Utilities, energy, infrastructure? Yawn.

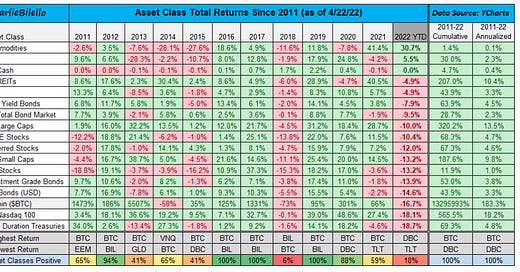

But this chart summarizes how hard it can be to predict which asset class will outperform in a given year:

I was hoping Charlie would include the standard S&P 500 returns in the above but the point is made. To all the people who believe they would be better off in cash, look at that 4.7% cumulative return.

Thanks but no thanks.

I know I sound like a broken record when I say every investing journey is unique and specific to that individual investor. But times like these can remind just about anyone the importance of staying diversified, take profits when you are able and stick to a long-term mindset.

When you want to sell, it’s probably not the right time. The markets don’t care who you are, they will always do what they want.

But the key, at least for me, is to never stop investing.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.