Q1 2022 Recap

Indices YTD Performance (1/1/22- 3/30/22)

The first 3-months of this year felt more like 3-years. The saying that, “things that have never happened before, happen all the time” seems to be as relevant as ever.

For example, most thought we would not see another senseless war like we are seeing with Russia invading Ukraine. For most of us, we have never experienced inflation, which is now running close to 8% and is certainly not transitory. Bonds, almost always considered ‘safe assets’, are having one of their worst years ever. The Bloomberg Barclays Aggregate Bond Index (broad-based fixed income index) has never been down two years in a row. Could this year be the exception?

Bonds through 3/27/22:

Thankfully, the luck of the Irish came through in the month of March. The S&P 500 is up roughly 10% in the past two weeks. The good news? April has historically been one of the best months of the year for the S&P 500. Let the good times roll!

Q1 served as a gut check for most investors. It was very dreary to begin the year, especially in February as we processed what was going on with Russia/Ukraine. Many felt like they needed to get out or make a move. But the month of March served as a reminder that staying invested can ultimately be your greatest decision.

Now, lets look at some key economic indicators and what it might mean for the months ahead.

Unemployment Rate:

Good News: The unemployment rate has fallen to 3.8% as of February 2022. This is a positive sign for the economy as the labor force continues to recover. This includes an increasing labor participation rate, which is still below pre-pandemic levels, but trending higher as more people get back to work.

Bad News: The major issue continues to be the amount of job openings and the impact on supply chains. Companies simply can not find workers to fill positions. As of the end of February, there were 11.3 million job openings. If you are saying to yourself, “well people just need to get off their ass and get back to work”, this chart shows that there are 5 million more job openings than unemployed people in America:

Inflation:

Everyone’s favorite topic! I think we can all agree that the Fed severely underestimated the rate of inflation. What’s important to understand is that inflation is a process, not an event. We can’t snap our fingers and hope that inflation goes away.

As a result of flooding our economy with liquidity over the past 2-years, consumer demand stayed high even though supply chains were critically disrupted.

To add even more pressure to this, due to the Russia/Ukraine conflict, countries have come to realize they can not depend on other countries to supply key inputs to their own economy. This increased spend on nationalizing supply chains will inevitably add more fuel to the inflation fire.

I certainly would not trade places with Jerome Powell right now. The Fed is tasked with cooling inflation while also balancing a slowdown in economic growth due to geopolitical events. Expect inflation to remain a problem this year as the impacts of the Russia/Ukraine war continue to impact supply chains, specifically commodities/food.

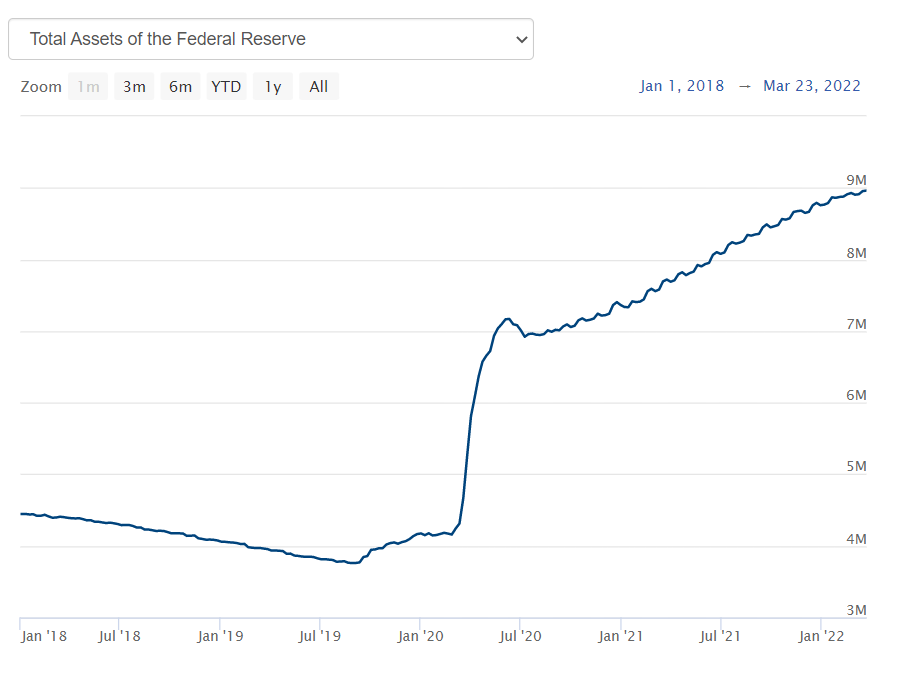

Not to mention the Fed continues to increase their balance sheet…

Source: Federal Reserve Board

Interest Rates:

The Federal Reserve finally raised rates by 25 basis points in March, with the expectation of maybe 5-6 more hikes this year. But raising rates can only do so much. It isn’t going to improve supply chains or end the Russia/Ukraine situation.

It may start to cool the housing market as the 30-year fixed mortgage rate is hovering near 5%, a massive increase in just a few months. This highlights the importance of locking in long-term fixed rates when the opportunity presents itself.

Pending home sales (which highlights transactions that have a closing date within 1-2 months), dropped 4% in February. This marks the fourth straight month of declines in pending home sales.

Americans still seem eager to purchase real estate as I continue to hear stories of sales going way above asking price and there still being serious demand. We will see if this holds up as rates inevitably trend higher.

Conclusion:

You will continue to see the negative headlines throughout the year. But in times of chaos, you always need to look at the bigger picture and assess what you can control. More often than not, crises can serve as a catalyst for innovation.

If we have learned anything about America in the past couple of years, its our ability to adapt and innovate. US Corporate profits continue to be strong and we will get more insight in the coming month as earnings season approaches.

While the chance of a recession has increased over the past few months, it is still unlikely we will see one in the next 12-months.

So, let this serve as a reminder to stick to your long-term game plan and lets crush Q2!

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.