Q2 2024 Review

Indices YTD Performance (1/1/2024- 6/28/2024):

As we reach the halfway point of 2024, the indices are off to a great start. The S&P 500 index is up 15% and now up 52.6% from its October 12, 2022 closing low of 3,577.03.

For context:

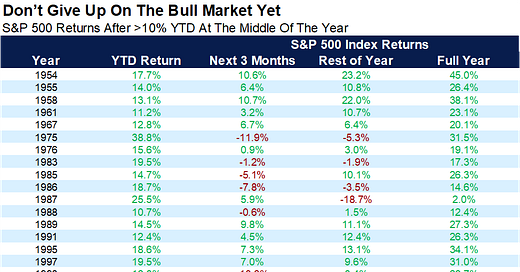

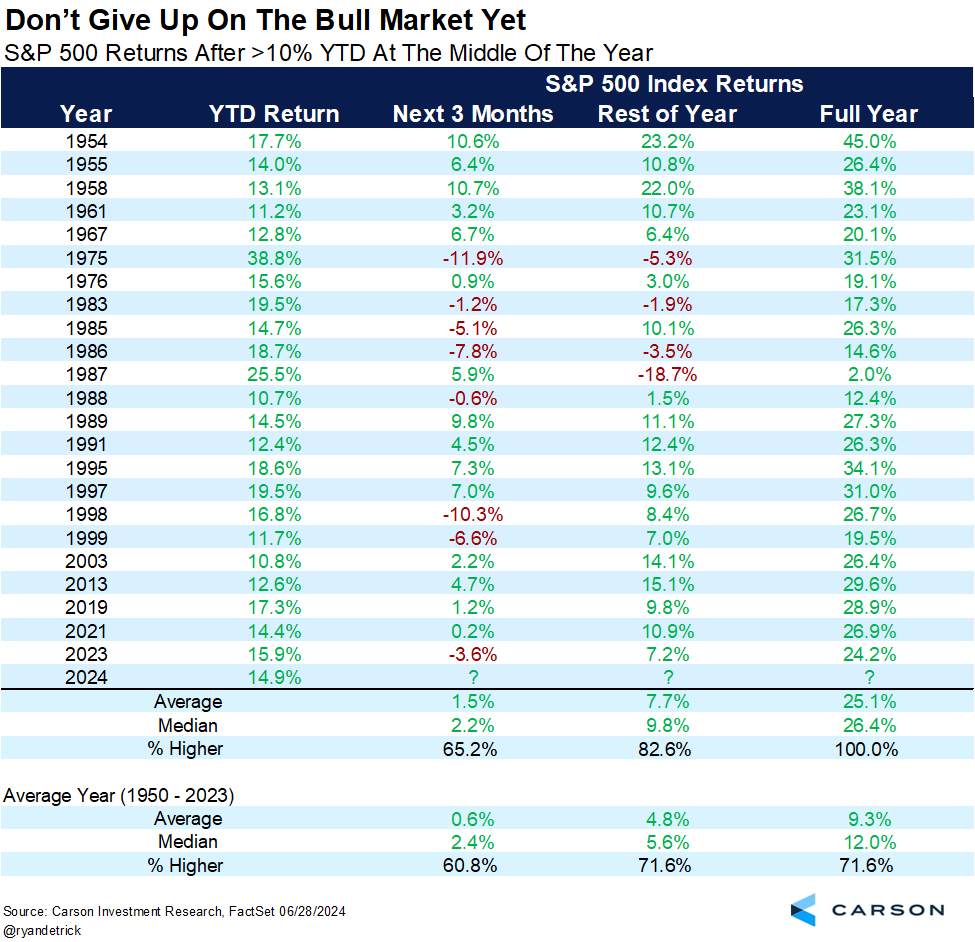

A 15% year-to-date total return in the S&P 500 is the 21st best run through June since 1900, according to Goldman Sachs. Among years when the index was up at least that much at this point, the rest of the year was up 72% of the time for a median further gain of almost 9%.

When we see double digit gains through June, the rest of the year tends to be strong:

Inflation Continued It’s Decline, But Remains Sticky:

The inflation rate peaked in June 2022 at 9.1% and has been on a decline ever since, indicating the worst is behind us.

The May CPI report highlighted inflation was running at 3.3% over the last 12 months, lowest since April 2021:

This is good news for everyone especially when you see shelter CPI move down for 14-consecutive months on a year over year basis.

It’s no wonder though why people are still angry. Yet this chart just gives me more reason to invest my money:

Interest rates set to come down, just maybe not as quickly as everyone had hoped:

Despite expectations for rate cuts, the Federal Reserve has yet to move. We have seen other countries begin to bring down their interest rates.

Feel like a broken record at this point talking about rates coming down. Yet another reminder that the economy can not be consistently forecast, nor the markets consistently timed.

Coming into this year, the markets had priced in a 100% probability that the Fed would lower rates by 1% prior to March 2025:

This is Not the Dot-Com Bubble:

Yes, the AI hype may be over extending the market in some areas. But corporations are doing well and generating cash flow and earnings, which is what should drive the valuation of stocks:

Sam Ro hits on this more here.

Bloomberg has current estimates for the S&P 500’s earnings to be up close to 10% this year, to be followed by a further 13.6% increase in 2025.

Higher earnings should mean higher prices for stocks.

Other Thoughts:

People are going to Italy and Greece…

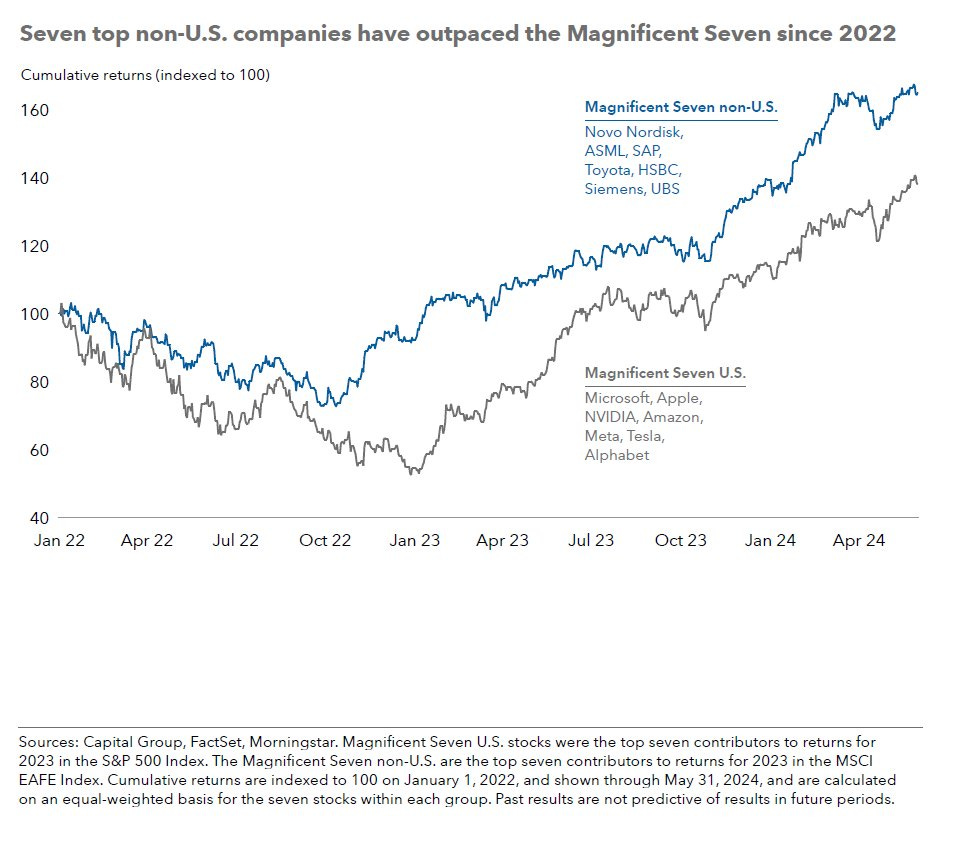

This may surprise you:

“If you love everything in your portfolio, chances are you don’t have enough diversification.”

High valuations, especially in tech stocks like Nvidia, have raised concerns about sustainability. Calls for rotation into undervalued sectors are gaining traction.

Valuation matters in the long run. and the price you pay for something matters.

Be Prepared for Pullbacks:

We have not seen much volatility in the markets as of late. As always, there are plenty of concerns out there: geopolitics, US election, rate cuts or a lack thereof, etc.

And the biggest risk is the one that no one is even talking about.

But for long-term investors, staying invested and weathering short-term volatility is key. You must be prepared to ride out the equity market’s frequent, often significant but historically always temporary declines.

Remember, on average we see a 14% pullback during the year at some point:

Good blog about people being too obsessed with cash:

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.