Q2 2025 Recap

This quarter was nothing short of a rollercoaster. Early April, we got to ride the Tower of Terror, when “Liberation Day” turned into “Obliteration Day”. Each day was intense and we weren’t quite sure where things were headed.

But for those who don’t pay attention to this stuff, they couldn’t comprehend that even after a 15%+ drop in a matter of days, all it did was bring us back to levels we saw in 2024…

Since early April, the markets have rebounded quickly. We are back at all time highs, which many people can’t comprehend..

The Vanguard Growth ETF (VUG) is up over 30% since then (top 3 holdings = MSFT, NVDA, AAPL). But it wasn’t just tech firms that have been leading the charge, we are also seeing other sectors with respective year-to-date gains:

International stocks have continued to outperform the US YTD. You have every right to be skeptical on if that will continued but with a renewed emphasis on global infrastructure, increased defense budgets, and trade optimism; this trade might just have legs to run…

Ben Carlson had a great blog highlighting the intense volatility and s*** we’ve been through since 2020. Yet, the S&P 500 has compounded at 20% annually…

Nick Murray put it best…

The best time to buy the great companies in America is when you have the money. The best time to sell them is when you need the money. Everything else is the madness of market timing.

Inflation & Tariffs

The CPI in April was up 2.3% year-over-year, a slight decline from March.

While we may not be at the Fed’s 2% target—which is an arbitrary figure anyway—inflation is trending in right direction.

Tariffs and a pending trade war still dominate the story and some would argue it’s the only variable matters.

A lot of this is just complete theatre in my opinion. Look at how the China progress has played out…

Has anything really changed?

But don’t worry guys, the deals are coming (this was from two weeks ago and not much has changed…)

Interest Rates

Boy does Trump have Powell’s face on a dartboard labeled “stupid person”…

The Federal Reserve held rates steady for the fourth consecutive meeting. Their rationale — tariff-driven price increases could jeopardize the progress in the fight against inflation. While rate cuts still seem probable later this year, the Fed seems to be in no rush.

You know who doesn’t wait for the Fed to cut? Your banks…Look at the rates on CDs, money markets, and high-yield savings accounts. Make sure you are putting your cash in the right spots…

Mortgage rates for a 30-year fixed, single family primary home, with over a 20% down payment still stands at around 6.5%.

Labor Market

Anecdotally, you are starting to hear about more layoffs and then it’s tougher to find a new job right away. Mostly for coders, analysts (entry-level), health care, government workers (kinda)..

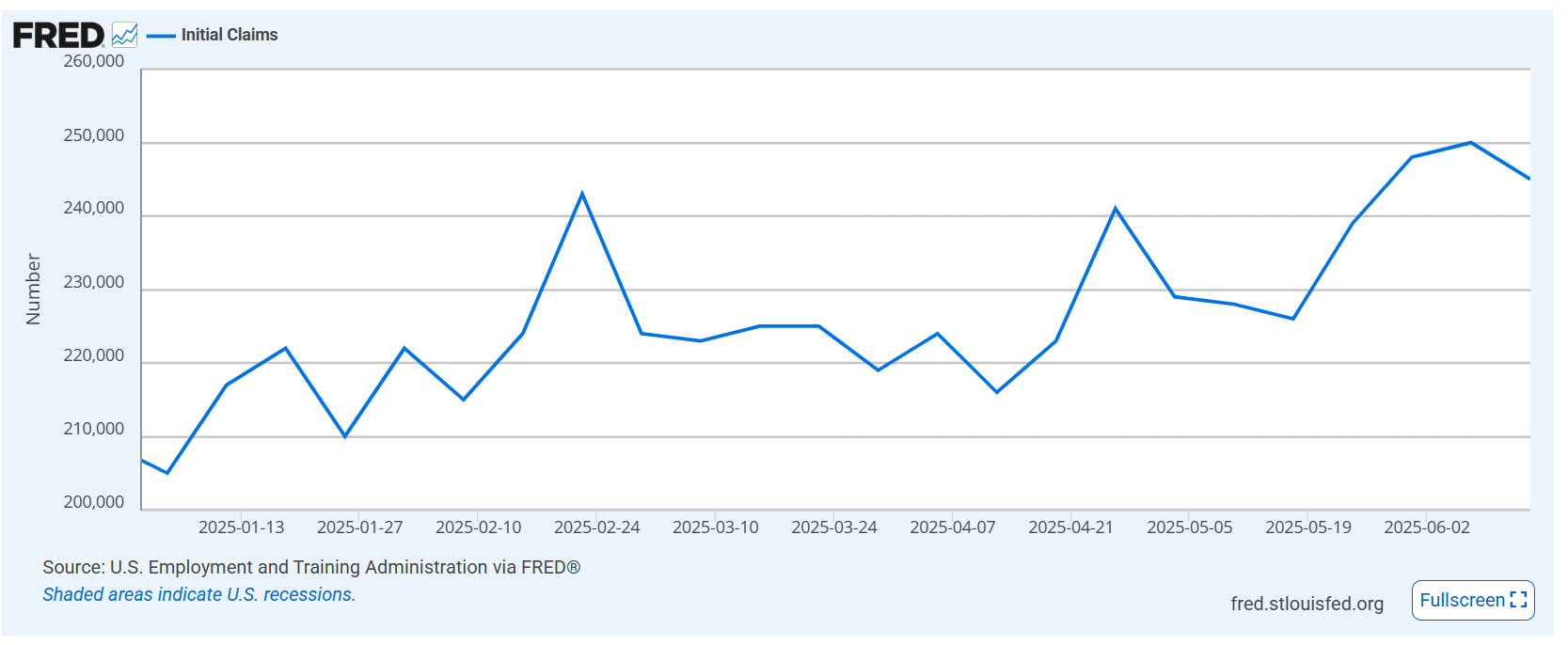

Initial jobless claims in a slight uptrend, but fairly moderate:

Look at some of the messaging from CEOs now, what a world we are living in…

People will keep spending as long as they have jobs.

Final Thoughts

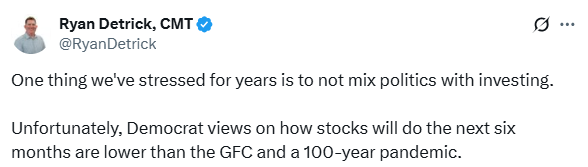

This quarter was another reminder that investor psychology matters. Emotional decisions, especially those driven by politics, rarely end well.

We’re in a strange time to be an investor. A market that moves by a Truth Social post from one man.

But I see a lot of people losing money, or just missing out on solid gains, because there is a sort of mental sickness that is driving their investment decisions.

What a disaster. You really need to try and have more perspective. In the heat of the moment we lose control and throw history out the window (“this time is different”).

I liked the way Sam Ro summed this up:

“There are way more people who want things to be better, not worse. And that demand incentivizes entrepreneurs and businesses to supply better goods and services. The winners in this process get bigger as revenue grows. Some even get big enough to get listed in the stock market. As revenue grows, so do earnings. And earnings drive stock prices.”

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.