Q3 2024 Recap

Indices YTD Performance (1/1/2024- 9/30/2024):

The best recession ever continues…

Shoutout fellow Hornet Josh Schafer as the source.

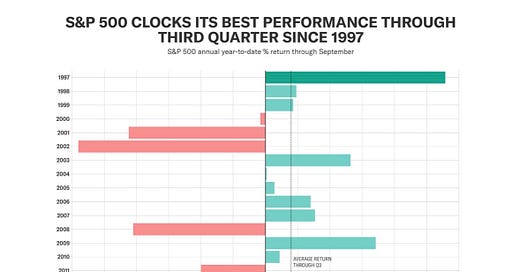

Through Q3, it has been a damn good year to be invested in the stock market. Essentially, every asset class is well into the green and bonds are also having a strong year.

Remember in early August when people were questioning everything? Yeah me neither…

Ironically, September is traditionally the weakest month of the year for stocks. Yet all three major averages posted monthly gains, and it was the first positive September for the S&P 500 since 2019. You did stay invested, right?

Unemployment Update:

All eyes are on the labor market to see if it can continue to be robust. First and foremost, the way these numbers are getting tracked is an absolute embarrassment. The constant revisions, that are quite significant, have to stop, but I digress…

The concerns for the labor market became elevated when the Bureau of Labor Statistics reported that the U.S. economy had added 114,000 jobs in July (revised down to 89,000 on September 6th 😊). This was below the consensus forecast, and a sharp slowdown from June.

The unemployment rate ticked up to 4.3% from 4.1% in June. This was its highest level since October 2021, and quickly shifted investors’ focus from happy thoughts of a soft landing and Fed rate cuts, to RECESSION!

Unemployment Rate since January 1, 2022:

The unemployment rate now sits at 4.2%. The fear is that when the unemployment rate accelerates, it typically means it keeps going. Initial jobless claims came out today and were slightly elevated. Certainly something to keep an eye on.

Interest Rates Coming Down:

The Federal Reserve officially lowered the Fed Funds rate by 0.50% in September. Bond yield have fallen across the board and we are already starting to see the rates on high yield savings account and money markets begin their decline.

Not good news for savers but great news for those that are in the market for a house:

Mortgage Refinancing Soars:

30-year mortgage rates are hovering right around 6% currently and I’ve seen some scenarios where you can go below 6%…

Election Year - I love Politics!!

This is pretty brutal huh?

But the market keeps chugging…

SPX vs. election year. The S&P 500 is on track for one of the best election years on record but history suggests weakness between now and the election.

I’ve heard from many investors that they want to hold off on investing some money to see how the election shakes out. I can’t disagree more with this strategy. If your investing timeframe is longer than 6-months, this shouldn’t impact your decision making.

The truth that no one likes to admit, at least as an investor, is that it usually doens’t matter who wins. As my partner Greg Munroe so eloquently put it, “It’s profits, not politics; it’s companies, not countries.”

Earnings are the most important driver of stock prices and we have good news on that front that Sonu Varghese pointed out:

Expected earnings per share for the S&P 500 over the next 12 months is now at $266, about 10% higher than it was at the end of last year.” -

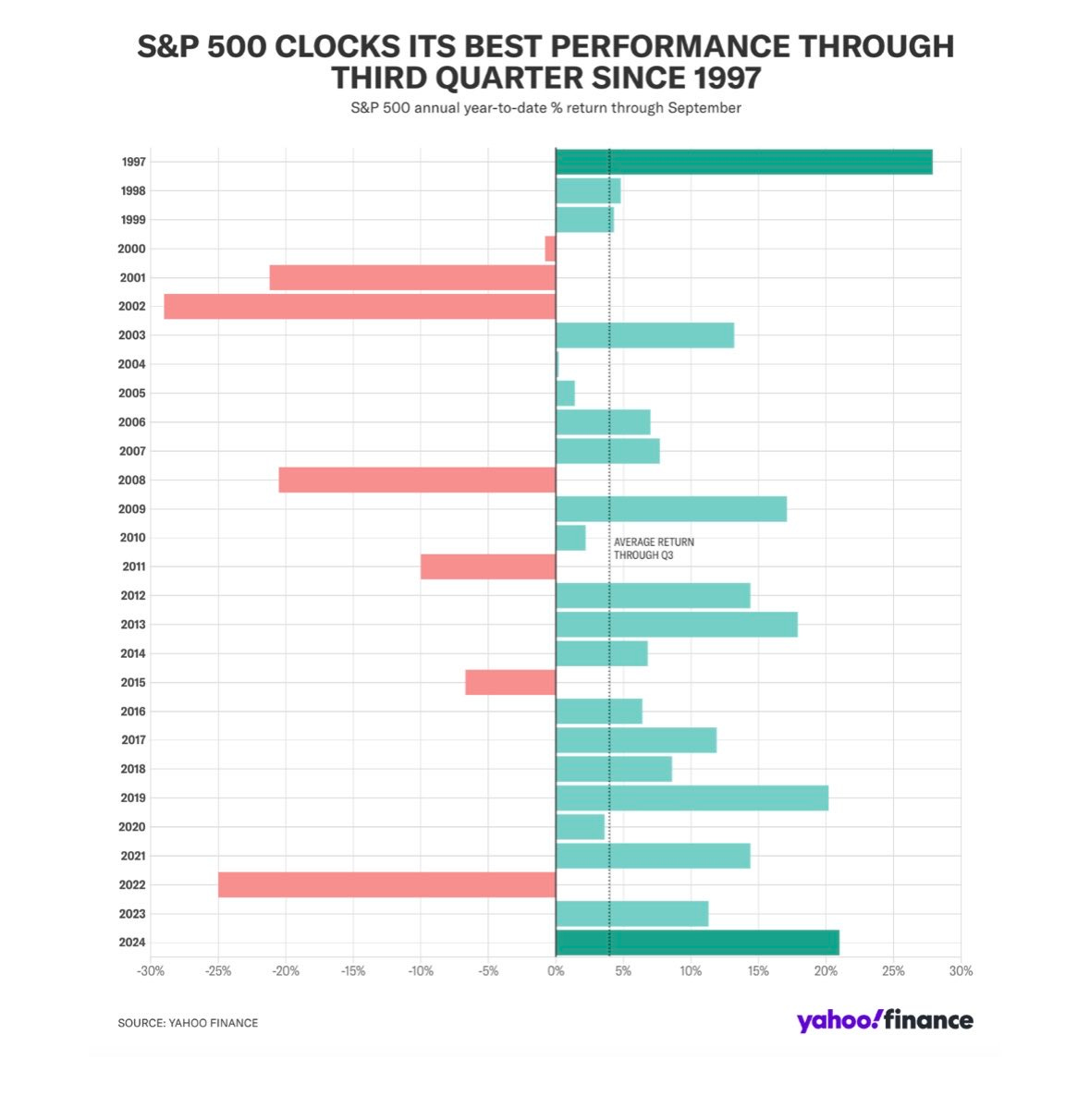

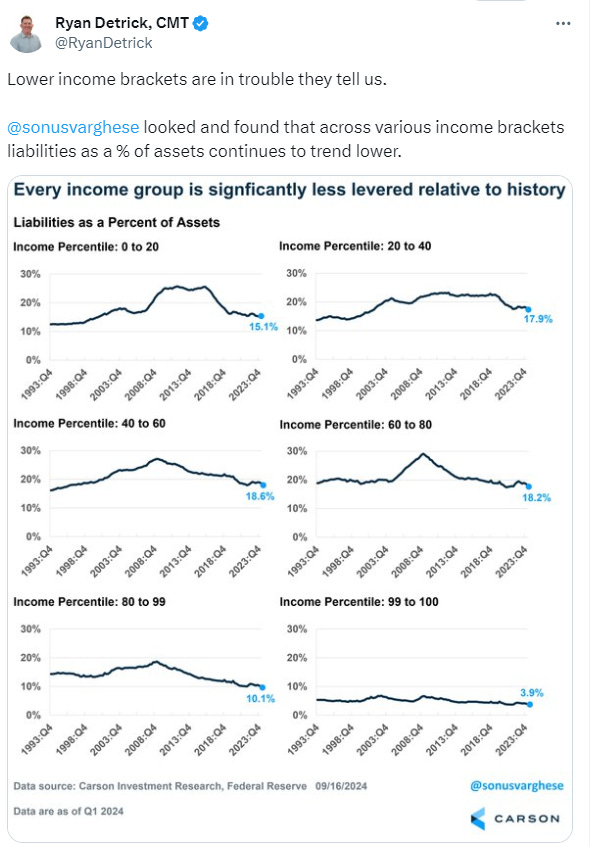

Consumers are less leveraged compared to history, still in good shape:

Expect Volatility, DUH!

Ryan Detrick hit on this as well,

S&P 500 up 20.8% heading into October could mean we finally see some red, with October lower 7 of 9 times stocks were up 20% or more heading into this spooky month. This isn't a bad thing though, as Q4 tends to still rally and we'd expect this to play out again in '24.

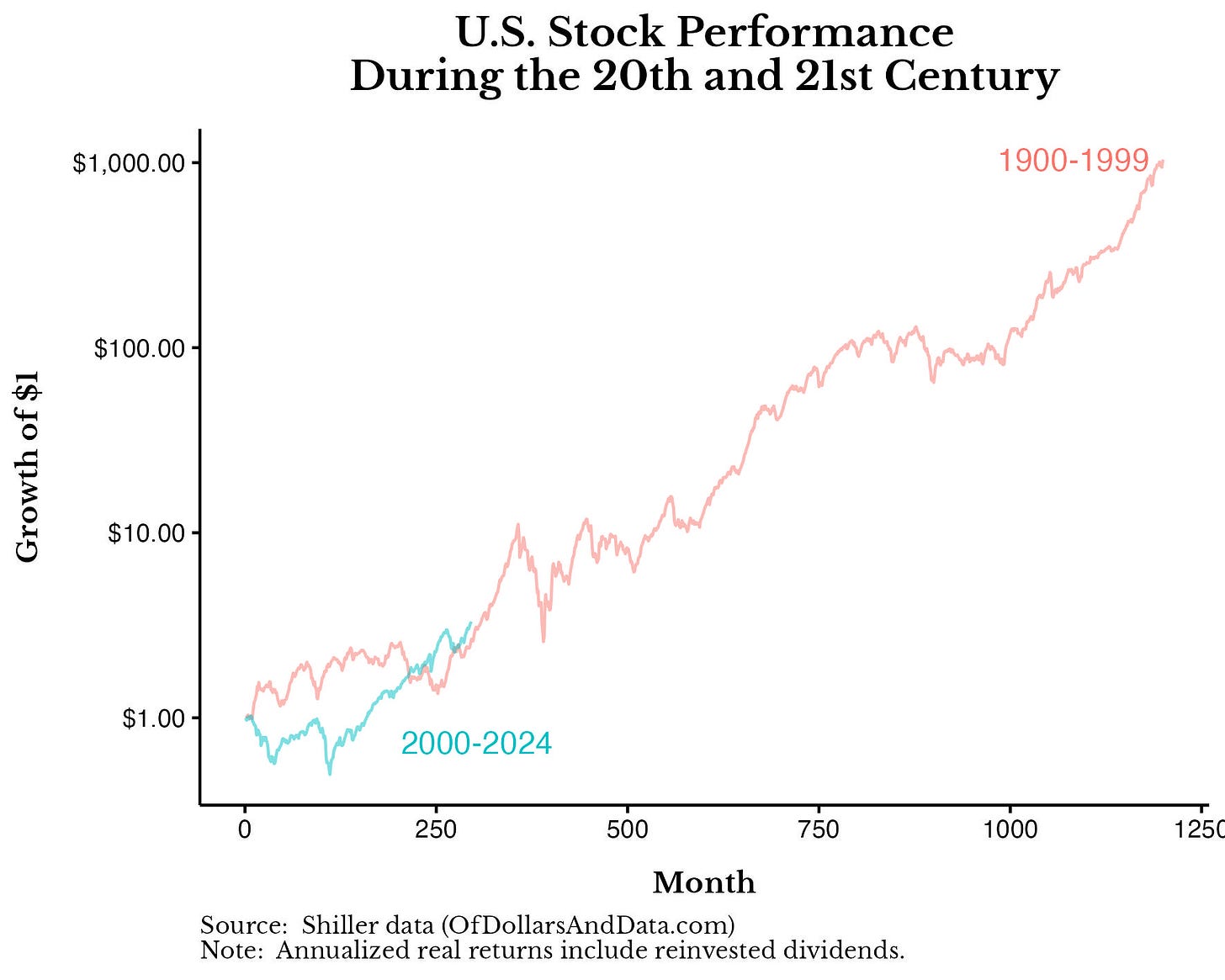

One of the most challenging aspects of investing is tuning out the noise of current events and staying focused on the long-term picture and your long-term goals.

In today’s environment, this is especially hard. Between the geopolitical conflicts, elections, social media; it can be non-stop and make you have paralysis.

But it’s that human nature aspect that is killing you.

As Nick Maggiulli puts it, “Just Keep Buying”; Fund your buckets, focus on your income and savings rate, live in moderation, and move the hell on.

Investing always works, it’s our human emotion that always tries to destroy it.

May I leave you with a few interesting charts:

When in doubt, zoom out…

Remember when they told us the market was only going up because of seven companies?

Ahhh life is so RICH! Stop letting other people try and make you poor.

Have a great Q4 everyone!!

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.