Q3 2025 Recap

The bull market continues with another strong quarter for stocks. Year-to-date, returns remain robust, and for the first time in a while, signs of the gains are broadening out beyond just large-cap technology.

Even small caps rallied 7% in August and hit their first new high since November 2021..

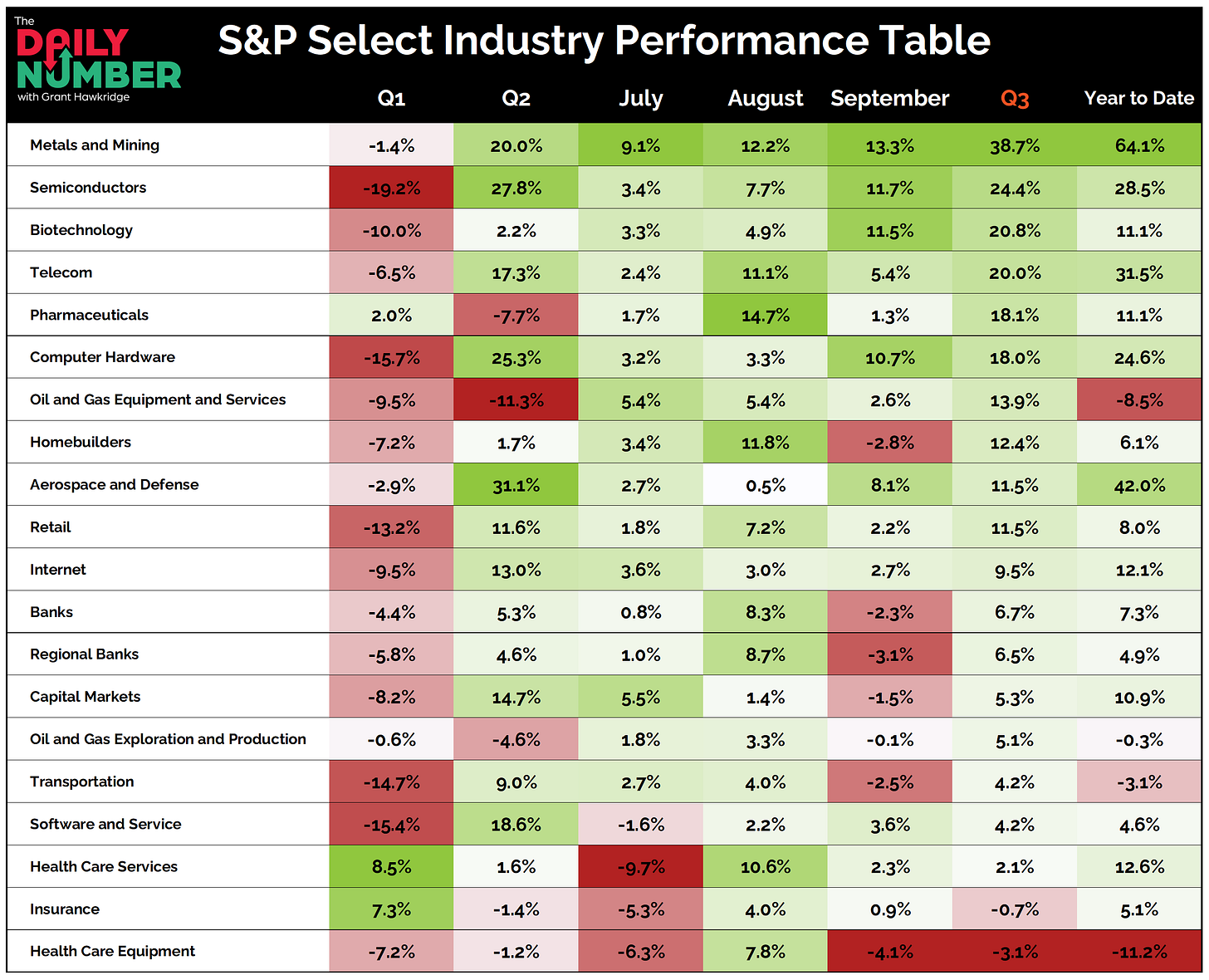

Grant Hawkridge with a nice breakdown:

Strength wasn’t narrow... it was everywhere. 90% of S&P industry groups finished Q3 positive. This was broad, trend-driven leadership into quarter-end.

Healthcare — woof…

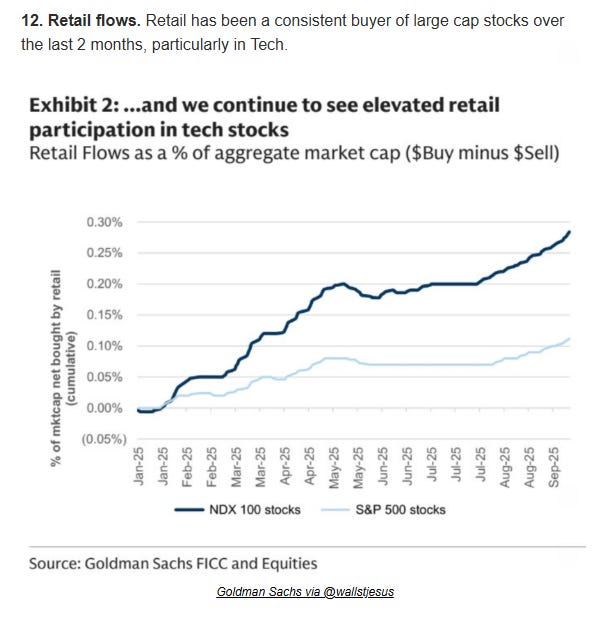

Yet, despite this broadening out, most of you continue to default to large US tech:

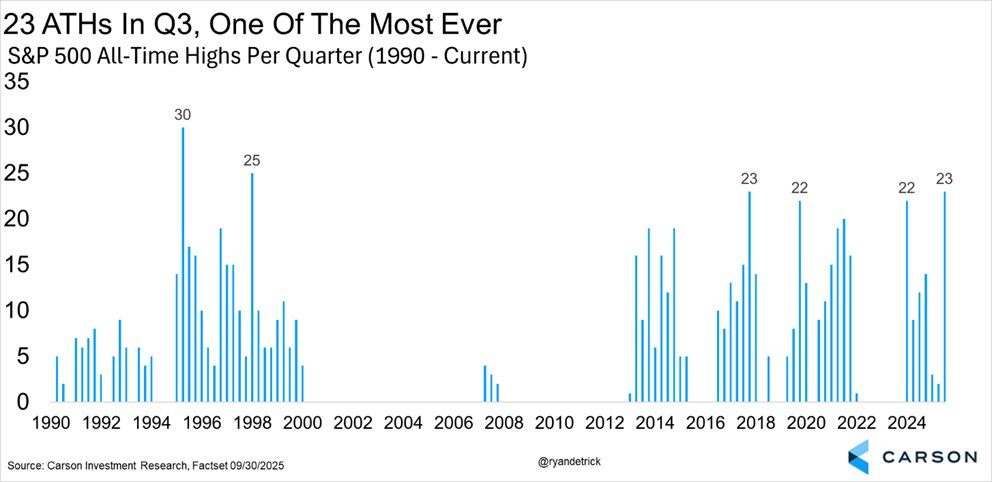

Ryan Detrick gives you a little nugget to chew on heading into year-end:

Up 10% YTD headed into Q4? October down on avg and up only 50% of time, but Q4 higher 14 out of the past 15 times.

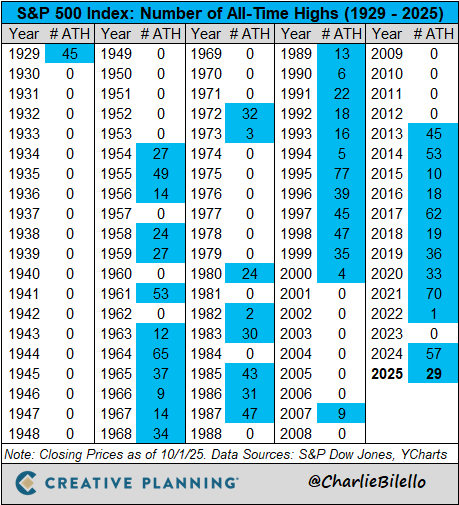

And for those keeping score at home, or if you run into a doomsayer…

Interest Rates

After a long pause, we finally got our first Fed rate cut in 2025. The Fed is walking a tightrope: inflation remains and issue but we are also seeing some cracks in the labor market.

Reminder that mortgage rates, CDs, high yield savings — all those rates move prior to the Fed. If you are waiting simply for the Fed meetings, we need to talk…

Earnings:

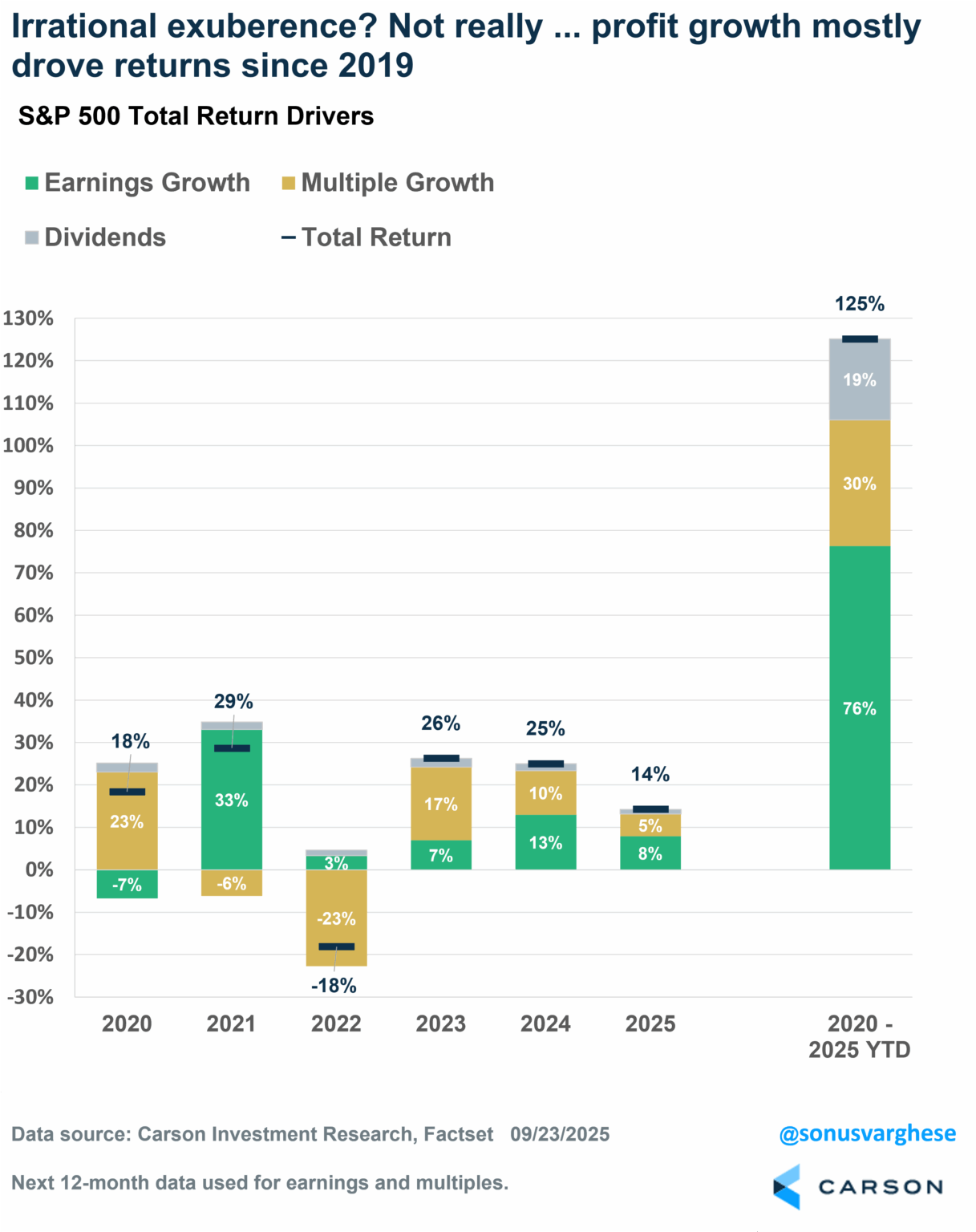

A lot of talk out there — “are we in a bubble?”

Sure, there are signs of madness, but corporate earnings remain the heartbeat of this bull market…

Joe Weisenthal summed it up well:

People like to blame the Fed or ETF flows for the big bull market. But the fact of the matter is that the realized earnings of big American companies have been extraordinary both on an absolute basis and also on a relative (to estimates) one for years.

Have we seen an absurd amount of government stimulus over the years? Yes.

But keep this in mind…

Since 2019 the S&P 500 is up 125%. 76% of that is coming from earnings growth and 19% from dividends. No, this isn’t a bubble, this rally is justified from strong earnings growth (Detrick).

Inflation & Tariffs

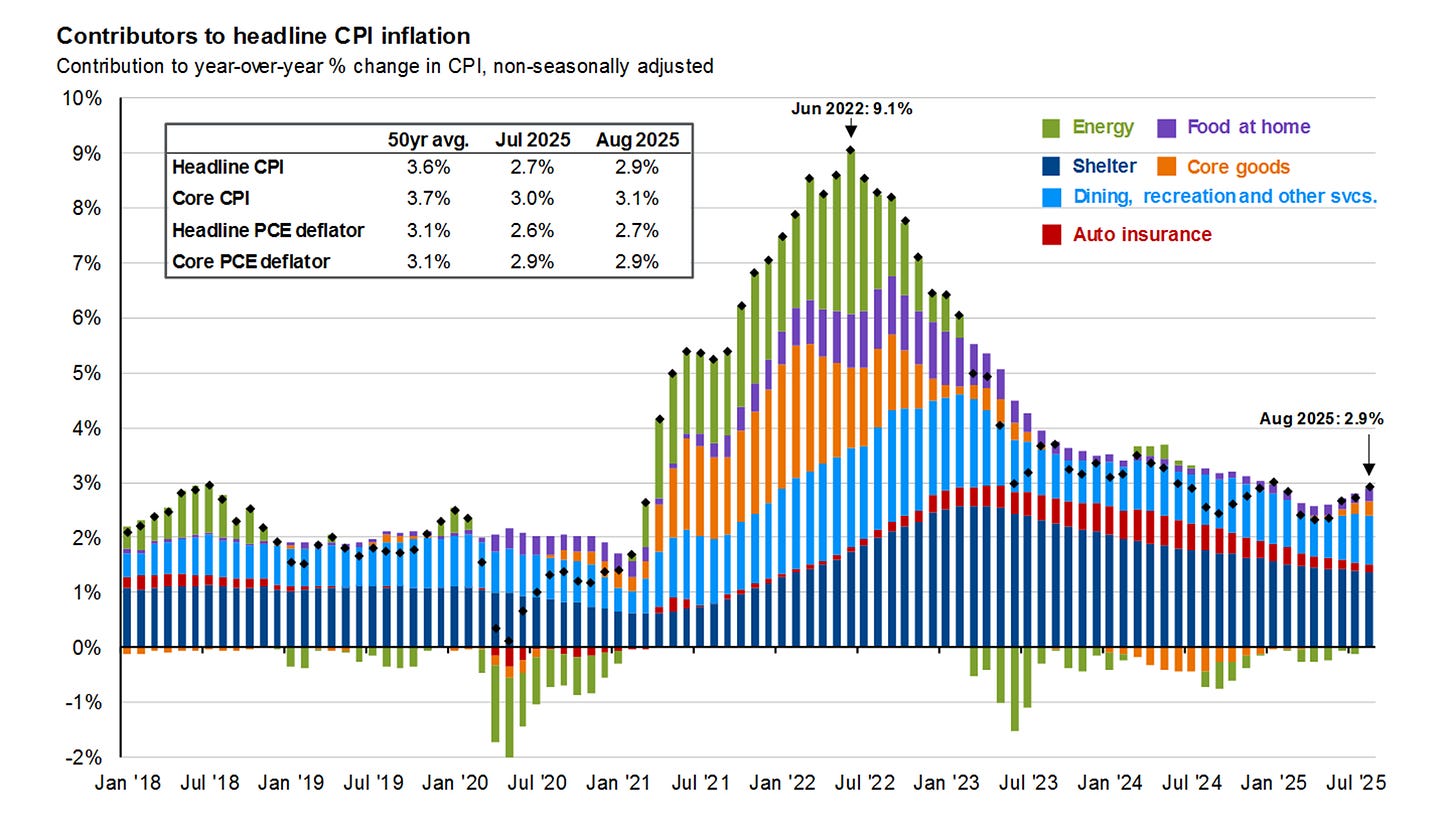

Inflation progress has stalled somewhat.

Core PCE inflation—the Fed’s preferred measure—was 2.9% in August, up from 2.6% in April. Both the three- and six-month annualized rates are running between 2.5%–2.9%, showing stickiness.

I’m skeptical of this pursuit to get us back to the 2% inflation target, but who knows.

Tariffs are also playing a role. Currently, about half of U.S. imports are under tariff, and while the aggregate impact has been manageable so far, sectors like consumer staples are beginning to feel pressure. Higher input costs could limit margins in the quarters ahead.

I like this chart from the JPM Guide to the Markets, which highlights the different components driving CPI:

Shelter should continue to trend lower but core goods inflation seems to be ticking higher and might keep increasing with tariffs..

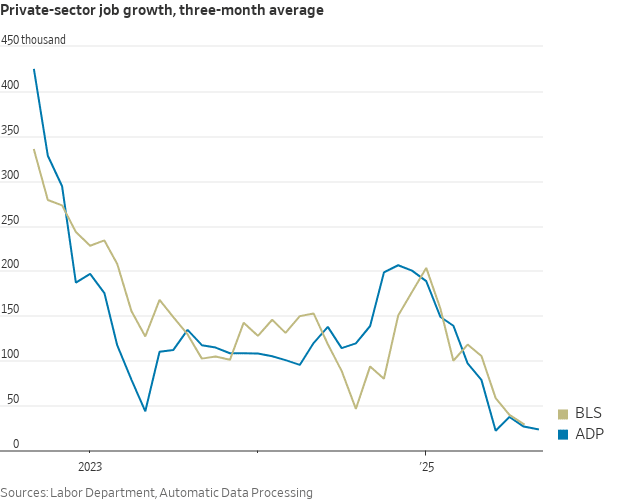

Labor Market

The labor market is slowing and many are referring to this environment as “slow to hire, slow to fire”.

From Nick Timiraos:

Negative job growth in June ends the current streak of monthly payroll gains at 53 months, the second longest on record (but well shy of the streak of 113 months that ended when Covid hit in 2020).

Where Do We Go From Here?

I’m optimistic headed into the home stretch for this year. Yes, October could deliver some volatility, but historically, strong YTD performance has been followed by strong finishes.

It’s been eerily quiet, essentially no 2%+ down days for the market, which is rare.

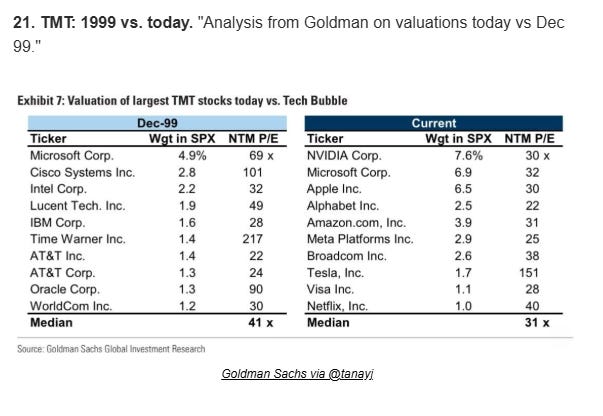

Valuations are stretched, but they aren’t completely insane compared to history (through 9/24/25):

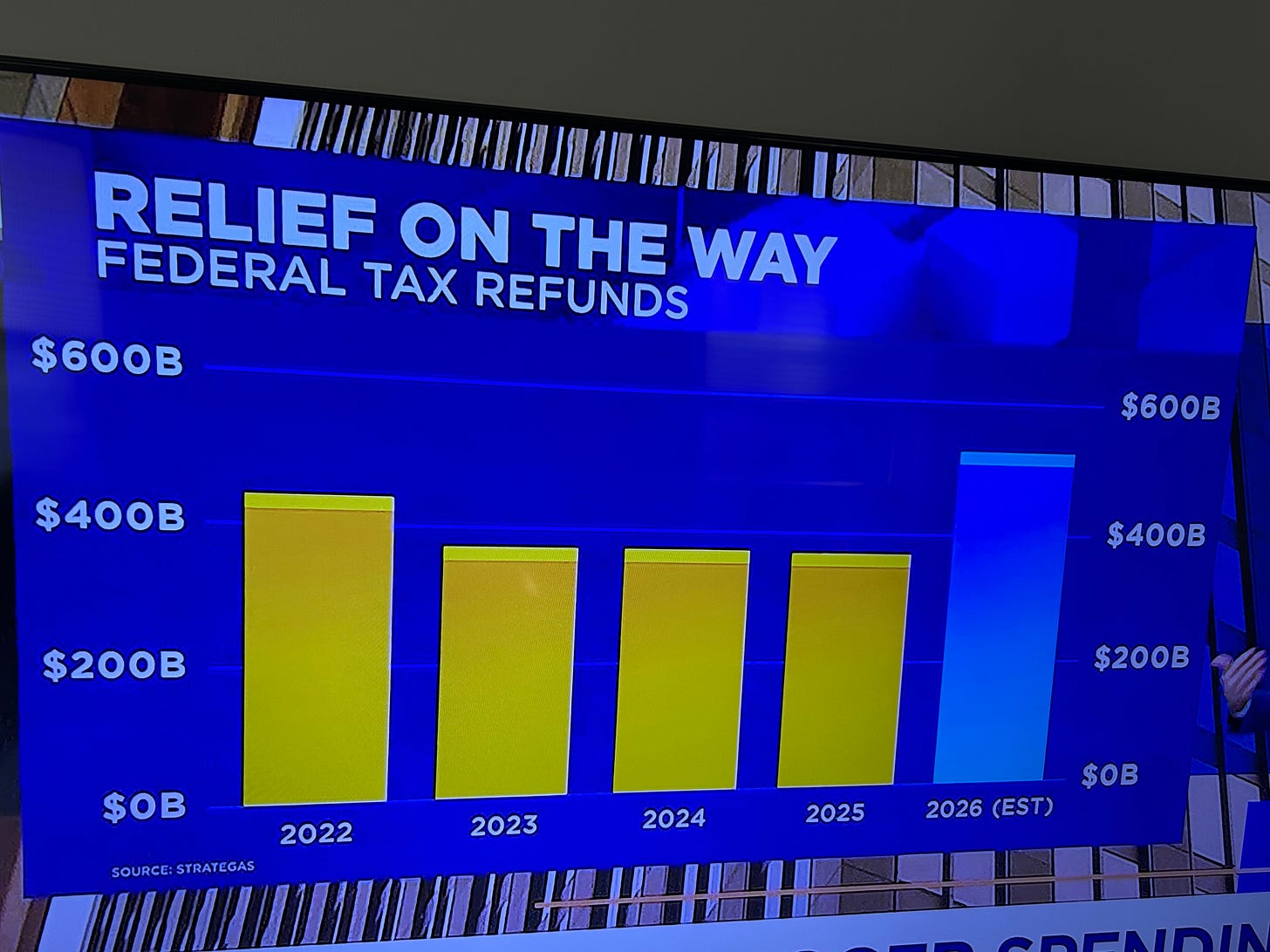

Another point that isn’t getting a lot of attention are the tax cuts.

Mike Santoli noted on CNBC Wednesday that with the recent tax cuts, higher itemized deductions (including changes to the SALT cap), a larger standard deduction, and the additional senior deduction, many taxpayers are likely to see larger tax refunds.

Those refunds could help pay down debt—or, as is often the case with you bastards, simply be spent elsewhere…which is stimulative for the economy:

Yes, I did take this on my phone…

Anyway, enjoy these good times, they won’t last forever. If you are kicking yourself saying, “I missed it…”, I wouldn’t be so sure.

This rally certainly has room to run, but it won’t just be up and to the right…

The key, as always: invest with money you can hold for the long run. Market cycles will turn, headlines will shift, but patient investors who stay disciplined are typically rewarded.

Let’s finish the year strong…

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.