This Week’s Stock Market Selloff: Panic, Pain, and What Investors Can Learn

What a week it's been — whether you pay attention to the stock market, casually watch CNBC, or just anyone who is not living under a rock with Patrick Star. The markets have been in full-on chaos mode. Whipsaws, panic selling, and daily losses that feel like punches to the gut. It’s exhausting. It’s disorienting. And yet… it's one of the best moments to learn about yourself as an investor.

Volatility Is the Price of Admission

If you’re invested in stocks, you’re probably learning whether or not you can actually stomach what it takes to earn long-term returns. A 15-20% loss in three days? That’s brutal. If you own individual stocks, you are likely down more. That’s not a knock — it’s just reality. And if you’re realizing this kind of volatility is too much, that’s okay. But it’s important to be honest with yourself.

The upside of that pain? You also get days like Wednesday — a 9-12% rip higher in a single session. That’s the trade-off. The market doesn’t wait around for your emotions to stabilize. It just moves.

This is a good time to ask: can I emotionally handle this?

You Cannot Time the Market - Read. That. Again.

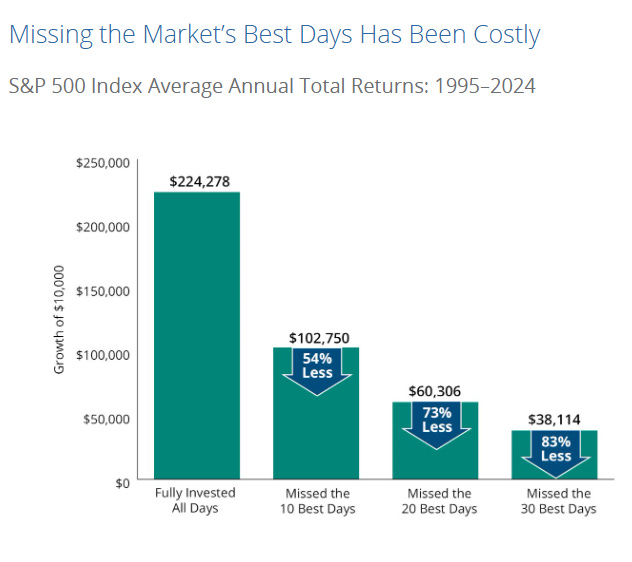

Understand the market is always forward looking and will bottom before the headlines confirm we’re in a recession. That’s just how it works. So if you’re trying to “wait for the dust to settle,” odds are you’re going to miss the best days. And missing the best days? That’s where your long-term returns go to die.

Hypo growth of $10,000

Source

Look at this week. Say you went to cash on Monday after back-to-back 5% down days and a brutal open. But then came Wednesday — a monster rally. Now what? Get back in? Sit it out? Your mind is in a pretzel. And that’s how people get wrecked. Now we get another sell off today…

Personally, I’ve got to put my hand up — even I’ve been feeling it. I was nervous or maybe tired is a better word. Markets dumping and most people are very negative. But my strategy hasn’t changed. I know every dollar I put into the market is long-term money. When stocks fall, I buy. I simply don’t have enough cash right now. I just may need to raise the rent on my roommate just so I can invest more. That’s who I am. That’s what I’m comfortable with. But you need to know who you are.

What the F*** Is Going On?

This stuff is truly wild.

Yes, we knew tariffs were coming. But nobody expected the President to hold a WWE-like poster in the Rose Garden starting an Armageddon — 30% tariffs on allies, arguably a complete joke on how the tariff percentages were determined (are we taxing penguins now?). It’s laughable if it weren’t so serious.

He's a negotiator, right? So maybe this was the play all along: go big, go loud, and then walk it back. But in the process, he unleashed absolute chaos. A Gong Show of a rollout.

One day top officials are saying, “We don’t care if the markets get crushed — it’s Main Street’s time.” The next day, they’re celebrating that the market had one of its best days in market history. I’m sorry, but I’m throwing the challenge flag. This kind of inconsistency makes it nearly impossible for businesses to plan, invest, or hire. And that uncertainty? It trickles down — to layoffs, to hiring freezes, to less economic momentum overall.

And let’s be clear: recessions aren’t just a market pullback. You think you’ll just buy more when the market falls. Recessions mean job losses, business closures, real pain. If you're cheering for that just to get a "buying opportunity" — with all due respect — go f*** yourself. And you don’t root for that stuff.

This latest announcement might actually be a step in the right direction — or at least a nod to the reality that you can't tax the world all at once and expect it to go well. If you're going to implement tariffs, start with the biggest issues first. Focus your limited time and resources where they matter most.

Maybe they’ve realized that. Or maybe they just want to stop the bleeding in the markets. Either way, this isn’t over. But it’s a rare concession to reality, and sometimes, that’s a start.

Final Thoughts

There's so much noise right now. And in times like this, the best thing most investors can do... is nothing. But you can learn:

Maybe you wish you had more cash.

Maybe you wish you trimmed some gains earlier or did some rebalancing.

Maybe you realize you can’t predict what happens next.

Maybe you’re realizing what your real risk tolerance is.

Whatever it is — learn from it. Remember it. Because this is where real investors are made. This is when the money is actually made — you just won’t realize it until years later. Buying when you least want to is often when it matters most.

For long-term investors, and for those that are a little twisted in the head, this is an opportunity. I’m buying. Not because I like the pain, but because I understand the game. I'm in this for the next 30, 40, 50 years.

Good luck out there — and if you need someone to talk through the madness, I'm here.

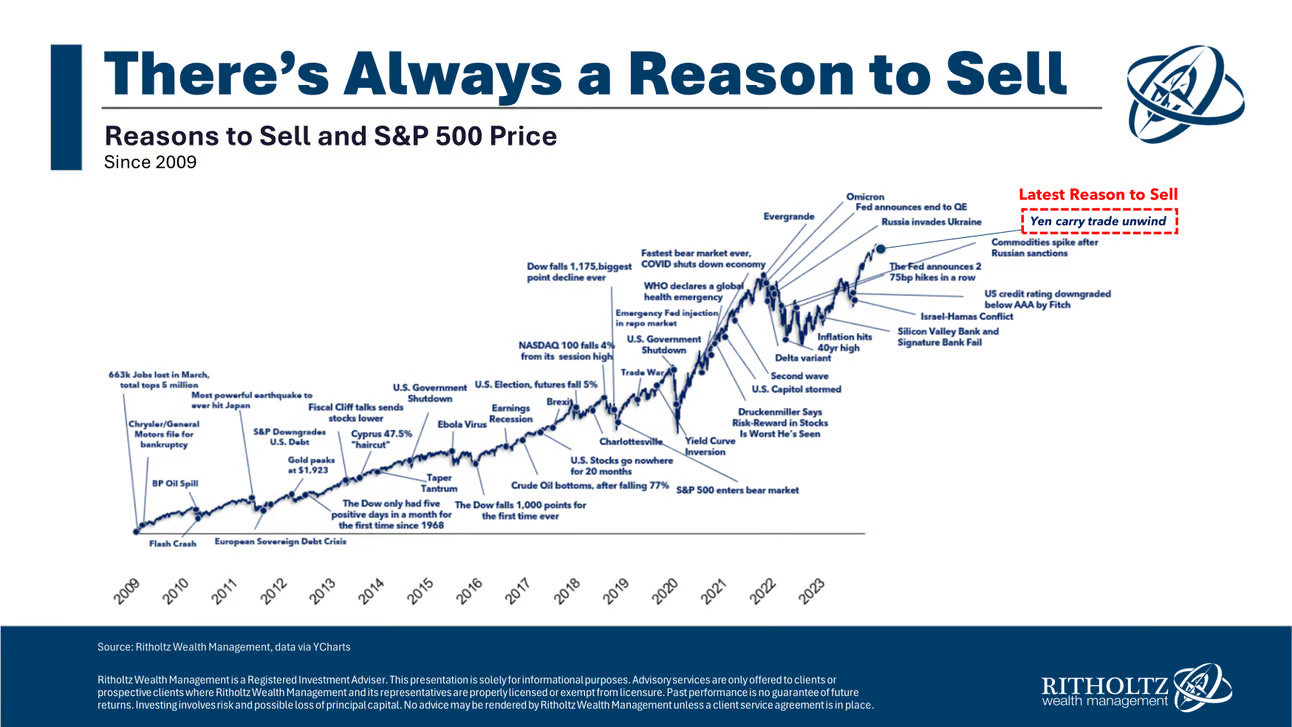

This is not 100% up to date, but the message stays the same — there is always a reason for you to sell:

Michael Batnick

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.