Just like your income, it’s not about how much you make — it’s about how much you keep.

I’m a big fan of having a taxable brokerage accounts (i.e. investment accounts) in your financial picture. But every investment decision you make, comes with a side of tax implications. I’ve stressed the importance of asset location, otherwise the Federal Government comes and takes your lunch money…

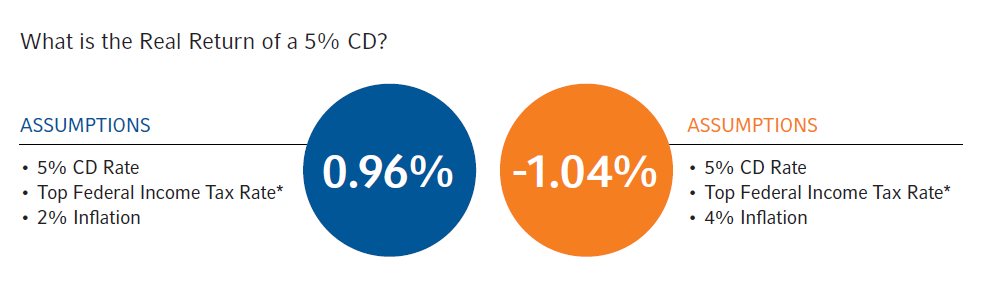

Majority of people look at investments and think, “What’s the return?” I’m a freak and look at them and ask, “What’s the after-tax return?” Because if you’re earning 4% but giving 40% of it away in taxes, you’re not making 4% — you’re getting taken to the cleaners.

Source

So what investments should be in your taxable account?

💸 Tax-Efficient Investments

1. Municipal Bonds (Tax-Free Bond Funds)

Look, I get it, these aren’t sexy. This isn’t a triple leveraged Nvidia fund that can go up over 100% in weeks. But if you’re in a high tax bracket and ignoring muni bonds, you’re out of your mind.

I get the pushback, “They haven’t performed well at all — it’s the only position in the red!”

Fair. But I don’t own muni’s for capital appreciation. I own them for tax-exempt income.

If you're in the 37% tax bracket, a 3.6% muni yield is roughly equivalent to a 6% taxable yield. You would need to find a CD or high-yield savings account paying you 6% to have the same after-tax return. Good luck finding one…

Want a little more juice? High-yield municipal bonds are yielding around 4-5%, which is equivalent to about a 7-8% taxable yield.

2. U.S. Treasuries - Interest earned is exempt from state income tax. Helpful in getting a state tax break and they are risk-free (hopefully for foreseeable future…)

3. Money Market Funds (Tax-Exempt Ones)

Emphasis on tax-exempt. I have a client that told me he was in a tax-free money market. I looked at his 1099 and had to break the news to them — all of that interest was actually classified as ordinary dividends (taxed as ordinary income). For them, that’s federal taxes of 40%+. The financial firm rebutted and said “the interest is exempt at the state level”. Thanks bud, mine as well hand them a Dixie cup to bail out a boat with a gaping hole in the hull.

Sure, you’re technically doing something... but it’s not doing shit to fix the problem.

📈 Individual Stocks, Equity ETFs, and Index Funds

Why do these work well in taxable accounts?

Individual Stocks: If you hold them for longer than 1-year, you qualify for long-term capital gains (lower tax rates). Plus, you control when to sell and when to realize gains. You can also do tax-loss harvesting for all your great stock picks..

Equity ETFs: Built for tax efficiency. Most don’t distribute capital gains like the boomer mutual funds your parents grew up with.

Index Funds: Even if they’re mutual funds, the passive strategy means low turnover — which generally means lower capital gains distributions.

🤷♂️ What Doesn’t Belong in Taxable Accounts?

Don’t go crazy but if you aren’t happy with the amount of taxes you are paying, then identify investments that kick off a lot of ordinary income — CDs, taxable bond funds, REITs, some dividend-heavy mutual funds. Those are best placed in tax-advantaged accounts (IRAs, 401(k), etc.). Let them compound away in peace, untouched by annual tax bills.

And if you’re really bullish on something? Maybe it belongs in your Roth — where you’ll never pay taxes on the gains if you hit a home run.

Not enough people are focused on their asset location, which can matter just as much as your asset allocation. It’s not enough to own good investments — you have to own them in the right places.

Let your taxable account be home to low-maintenance, tax-efficient investments. Keep the noisy, high-yielding stuff in accounts where the IRS can’t touch it — at least not yet…

If you're not sure where to start, I’ll happily review your current accounts, 1099s, etc. to help educate and see if I’d recommend any changes.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

Tax strategies should be tailored to your individual situation. Consult a qualified tax professional or financial advisor to determine the best approach for your specific needs.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.