Even in tough environments, there will always be opportunities.

We should all be looking to get the most out of our money. Your money should work for you, not the other way around.

The negativity we hear on a daily basis can cause us to become paralyzed. Not sure if we should make a move.

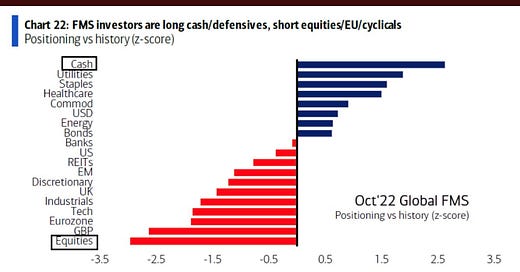

Most investors at this point are long cash and short equities:

As Nick Murray recently put it, “When everybody goes to one side of the boat, the way they have now, the boat capsizes.”

We never want to do zero. Those who take action are rewarded.

You should always have enough cash in your bank account(s) that make you feel comfortable. There really is no right number and this is more of an art than a science.

But if you have a lot of cash sitting in your checking or savings account, this money can be working harder for you.

Here are six ways you can put that cash to work:

Pay down/off high-interest debt: Whenever you have extra funds available, getting rid of debt should always come to mind. Interest rates are up significantly, so you should tackle debts that have high interest rates. These include credit cards, home equity line of credits (HELOCs) car loans, etc.

The interest rates on credit card debt is climbing towards 20% - the highest since 1990’s. Focus on paying these debts down then prioritize saving as much of your income as possible.

Open High-Yield Savings Account: Think of this account as an alternative to your generic savings account. The money in this account can be accessed at any point. The only difference from your savings is you are actually earning some interest!

In January, the interest rate on most high-yield savings accounts was around 0.50%. Now you can earn around 2.35%.

I would assume your savings account is earning next to nothing.

For the visual learners:

The savings rates on these accounts can change at any time and typically track the Federal Reserves benchmark rates. Why not take advantage of these higher rates now? May not seem like much, but every dollar counts in this economy…

Series I Savings Bonds: These have exploded in popularity as inflation reached 9% during 2022. You buy these directly from the US Government and have the ability to purchase up to $10,000 per calendar year. Remember, you need to buy them on or before Friday, October 28th, to get the 9.62%.

Three other things to keep in mind with I Bonds:

1. Need to hold them for 1 year.

2. Years 2-5, 3-months penalty when you cash in.

3. Years 5-30, no penalty to cash out.

For more details, click here.

Certificate of Deposits (CDs): A certificate of deposit (CD) typically earns a higher rate than a high-yield savings account because you are locking your money up for a specified amount of time. But these can be a great option for cash you may not need for 12-36 months. As of now, you can around 3-4% on these.

If you cash in a CD prior to the maturity date, prepare to lose out on a significant amount of interest.

Treasury Bills: A Treasury Bill (T-Bill) is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of one year or less.

The length of these investments varies from 4-weeks to 52-weeks and can be a great way to earn some interest. You buy these at a “discount” and then they will mature at their face value, which is usually $1,000.

For example, I buy a T-bill for $980 and hold it for 6-months. I then receive $1,000 after 6-months, and the difference ($20 in this case) is the interest I received.

The interest income from T-bills is exempt from state and local income taxes. However, the interest income is subject to federal income tax.

If you don’t want to set up an account at the Treasury, these ETFs should be available to buy on your investing platforms: SHV 0.00%↑ BIL 0.00%↑ , SHY 0.00%↑

Here are the current interest rates (as of 10/26) that you can receive on Treasury Bills:

Stock Market: Yes, there are still plenty of reasons to be investing in the stock market.

This massively universal bearishness can’t last forever. Remember, nobody rings a bell at the bottom.

The best time to buy stocks is when you have the cash available.

I wouldn’t recommend putting money into this market if you may need it in the next 6-12 months.

But long-term investors may find that this downturn presented them a great buying opportunity.

We want to buy at the funeral and sell at the wedding, if possible.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

All investing includes risks, including fluctuating prices and loss of principal.

Disagree with this statement:

Most investors at this point are long cash and short equities.

You referenced a fund manager survey so this may related to institutional investors but certainly doesn't reflect the majority of investors.