Where You Live Matters — But Not Just for Taxes

Choosing where you live carries big financial considerations. Different income tax rates, property taxes, insurance costs, estate tax rules, etc.

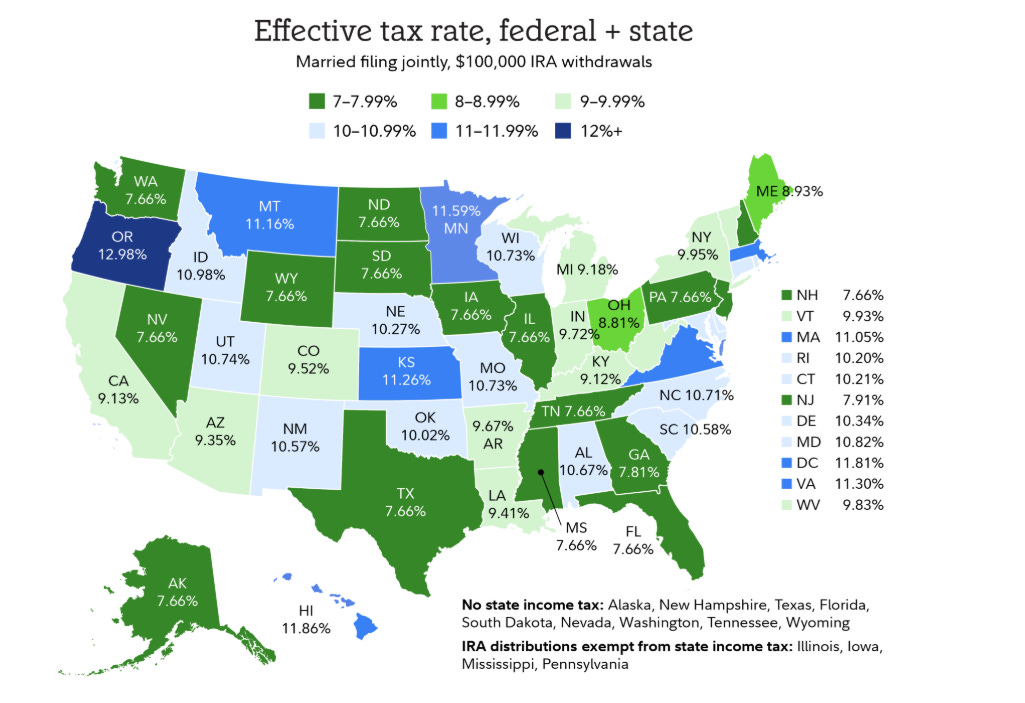

To give context — nine states have no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Four states do not tax income from IRAs. These are Iowa, Illinois, Mississippi, and Pennsylvania:

A lot of things have trade offs. California is beautiful, lifestyle is more lax, tons to do.

But you get smoked on taxes. If you make $1 million in the state of California, married filing jointly, you will have a good chunk of your income being taxed at 50.3% (37% Federal, 13.3% CA State Tax)…

I know, I know, pull out the worlds tiniest violin but that is a tough pill to swallow.

Thinking about retirement, most people take distributions from their IRA accounts.

The amount of taxes you owe on those distributions will depend on where you claim residency.

Here are the effective tax rates you would pay on a $100,000 distribution from an IRA per state:

Source

In the state of MA, you would pay roughly $11,050 in taxes. In Florida you would only pay $7,660 and in California you would owe $9,130.

It also pays to be in a relationship in more ways than one…

Source

But it’s not just income taxes you need to consider. Property taxes, homeowners insurance, or estate taxes.

Here are property taxes paid as a percentage of house value by state:

Source

Top 3 highest property tax states: Illinois, New Jersey, Connecticut..

Or, how about when you die?

Source

Moving to a state with no income tax or estate taxes can save people thousands. But I don’t recommend making these decisions based solely on dollars and saving on taxes.

Other factors need to be considered — exposure to opportunities, school systems, convenience, commute, proximity to family and friends, weather, quality of life, property values, rental cost or potential rental income.

Having a strong social network, being close to family, having a good commute, and ability to explore other areas of interest are so much more valuable than the taxes saved.

Consider this if you are offered a new role that upends everything and puts you in a place you don’t want to live. Maybe you can handle it for a few years but the mental and social costs will outweigh the financial savings.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

Please consult a tax professional to learn more about your specific situation.

All investing includes risks, including fluctuating prices and loss of principal.