One of the most frustrating things when discussing personal finance is that the answer is always "well, it depends..."

While that is true, I’m here to tell you that regardless of your age, income, or where you live, you need a Roth IRA.

Why? Because it’s one of the most powerful wealth-building tools available, and it provides financial flexibility.

What is a Roth IRA?

A Roth IRA is a retirement account where you contribute after-tax money—meaning you don’t get a tax deduction today. Rather, all of your earnings grow tax-free and all qualified withdrawals in retirement are also tax-free. The kicker — you need earned income in order to contribute to a Roth. Yes, if you have $500,000 in a Roth IRA, and take a qualified withdrawal of $500,000, your tax bill is $0.

Main Benefits:

Tax-Free Growth & Withdrawals

Unlike a traditional IRA, where you defer taxes, Roth IRAs let your investments grow completely tax-free, and when you take the money out in retirement (after age 59½ and meeting the five-year rule), you owe nothing to the IRS.No Required Minimum Distributions (RMDs)

Traditional IRAs force you to start withdrawing money at age 73 because the government wants its tax revenue. But a Roth IRA? No RMDs. You can let your money grow as long as you want, which is a game-changer for wealth-building and estate planning.Access to Contributions Anytime

Life happens. Need money for an emergency? With a Roth IRA, you can withdraw your original contributions at any time, tax- and penalty-free. (Just don’t touch the earnings unless you want to deal with the IRS!) There are even exceptions when you can tap into the Roth and avoid penalties, such as first time home buyers.Tax-Free Inheritance

Want to leave money to your kids or grandkids? A Roth IRA allows beneficiaries to inherit tax-free dollars. Beneficiaries of a traditional IRA will owe ordinary income tax on the withdrawals…

But What If I Make Too Much?

The IRS does have income limits for Roth IRA contributions, but that doesn’t mean you’re out of luck. You can contribute to a Roth 401(k) if your employer offers it (no income limits there), use a Backdoor Roth IRA strategy, or do Roth conversions.

Also, you can only contribute $7,000 ($8,000 if over 50) into a Roth IRA but 401ks allow you to put away $23,500 ($31,000 if over 50) so you can build an even bigger bucket of tax-free income within your 401k.

Is a Roth Always Better Than a Traditional IRA?

Alright, don’t hate me but, it depends…

If you expect to be in a higher tax bracket in retirement, a Roth IRA makes more sense—you pay lower taxes now and get tax-free withdrawals later.

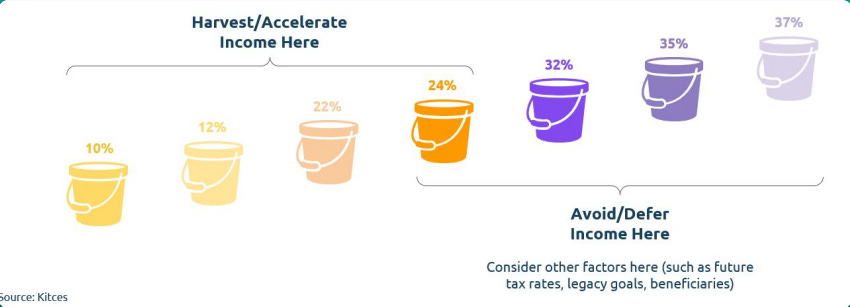

If you’re in the 35% or 37% tax bracket today, and expect to be in a lower one in retirement, then I’d prioritize say a Traditional 401k now and then focus on building a Roth bucket later.

But here’s the thing: everyone thinks they will be in a lower tax bracket once retired. That’s not always the case. Factor in pensions, social security, dividends/interest, IRA distributions — things add up fast…

If you’re in your 20s, your income is probably on the lower side, meaning you're in a lower tax bracket. This is a perfect time to pay taxes upfront, fund the Roth IRA, and let that money grow tax-free for the next 30+ years. By the time you retire, you could have a substantial amount of tax-free income waiting for you.

A Hedge Against the Unknown

Flexibility in Retirement – With a mix of Roth and traditional accounts, you control your taxable income in retirement. Need money but don’t want to push yourself into a higher tax bracket? Pull from the Roth.

Future Tax Uncertainty – believe it or not but current tax rates are low compared to historical rates. Who the hell knows where the rates will be 10 years from now but Roth’s are a good hedge against tax rates going up in the future.

More and more people are coming around on Roth IRAs. Again, these are still fairly new as Roth IRAs became available in 1998.

I truly believe a Roth IRA is one of the best retirement tools out there and something that I’m actively contributing into over the years. Whether you’re in your 20s or 60s, a Roth IRA should be considered. And if you’re not eligible to contribute directly, don’t panic—there’s always a way to get money into a Roth.

So what’s your excuse for not having one?

Start funding that Roth IRA today—your future self will thank you.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

Individual circumstances can vary, and tax rules may change over time.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.