Why Normal Market Declines Still Surprise People

Humility is the edge most investors ignore...

We’ve seen a bit of a market selloff lately, and you can feel the anxiety and uncertainty creeping back in. Some of that is concern, but a lot of it is simply a misunderstanding of what “normal” looks like in markets. The reality is: nothing unusual is happening.

Since the lows of 2022, the S&P 500 is still up roughly 80% over that three-year period. That kind of move doesn’t happen in a straight line. Markets humble everyone, and they always will.

Cliff Asness summed it up nicely on a recent episode of Odd Lots: investors only really get one “high five” moment—when they retire as a professional money manager or I’d argue an individual investor who accumulated enough that they no longer need a lot of risk exposure to hit their goals.

Before then — don’t celebrate until you have officially crossed the goal line…

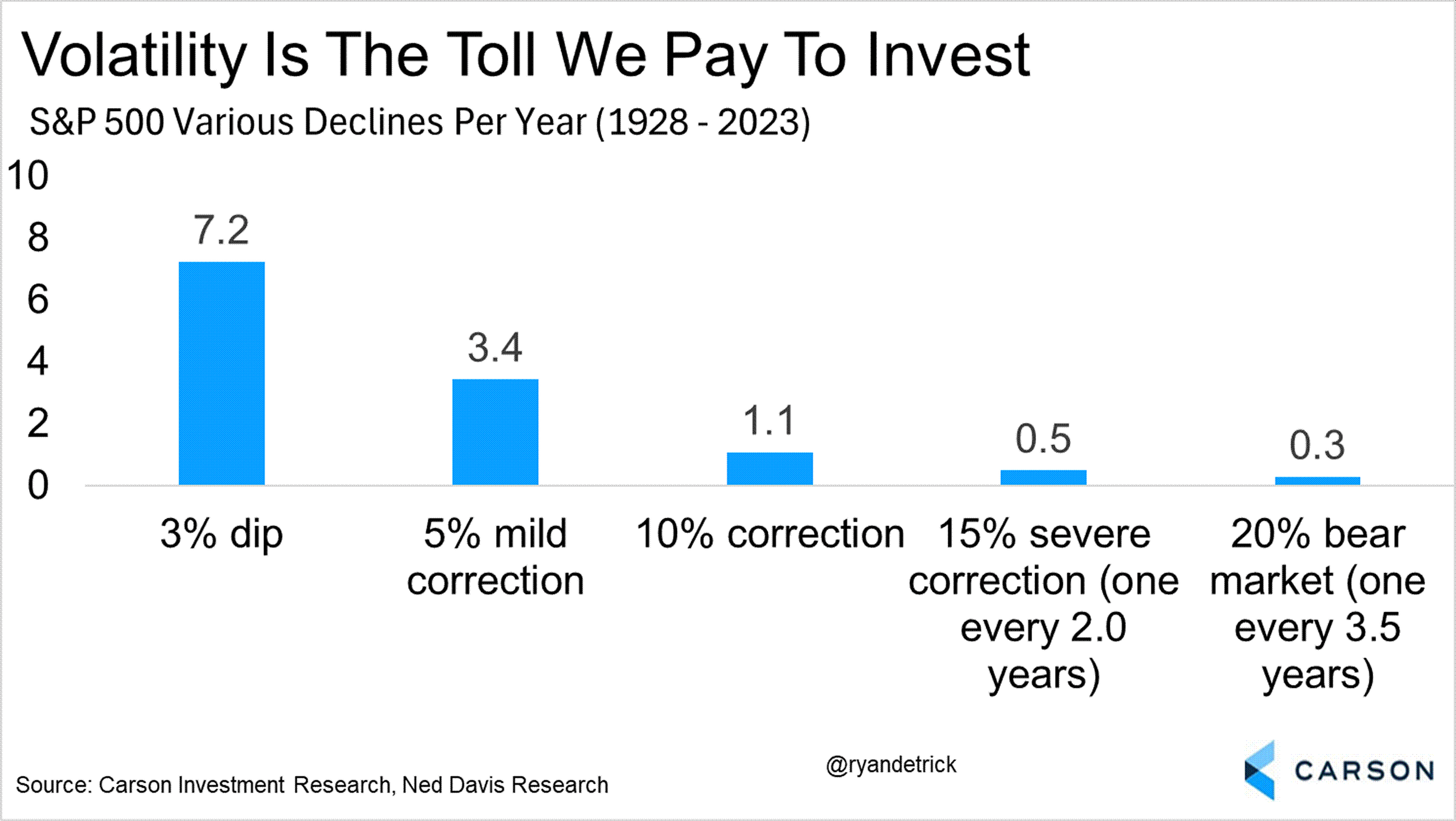

Here’s the thing that most people can’t wrap their heads around with the stock market: Volatility is the price of admission.

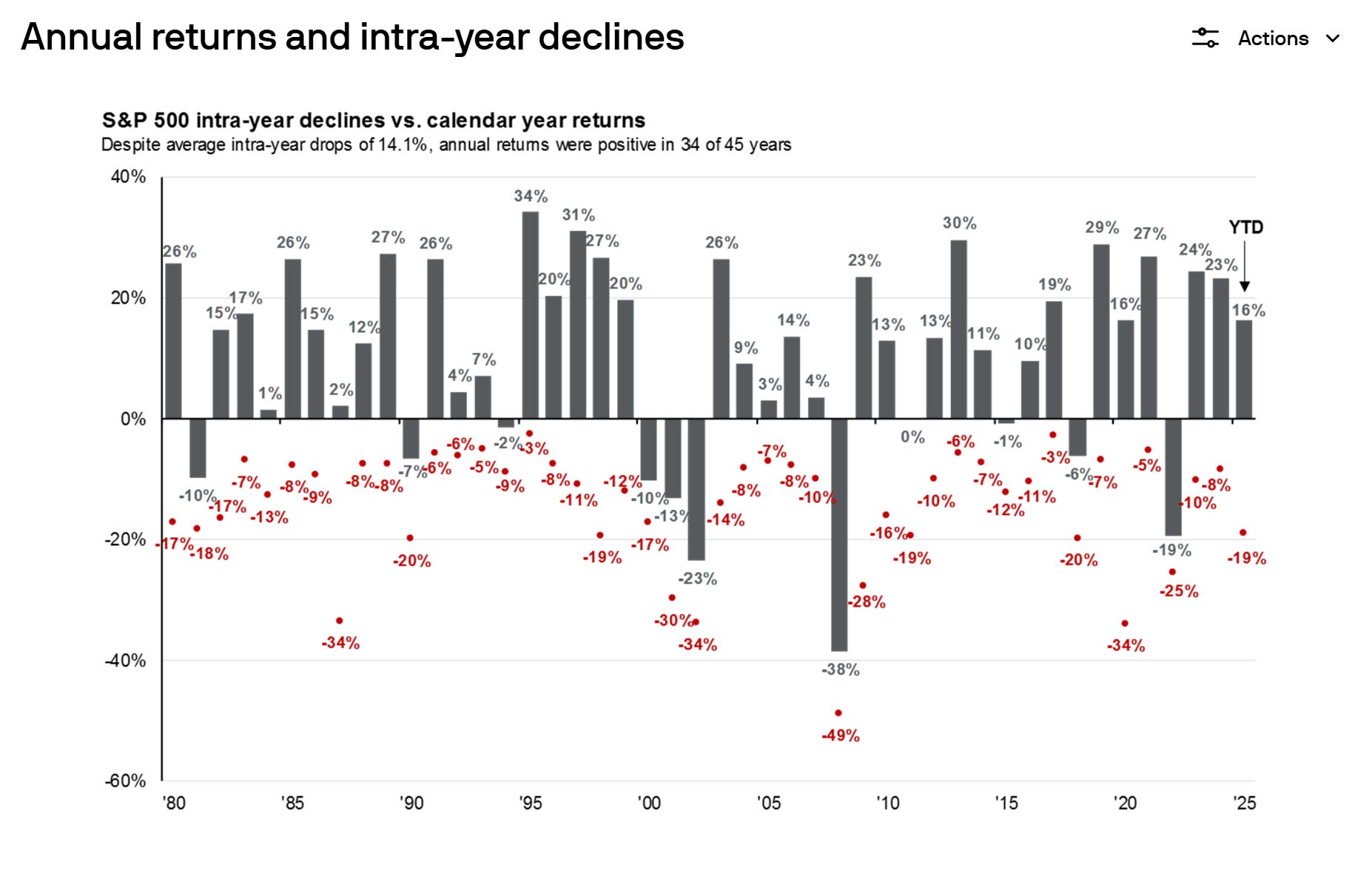

JPM Guide to the markets never misses…this chart is through October 31st:

You need to EXPECT that the following will happen on average:

A 3% drop happens seven times a year.

A 5% pullback happens three times a year.

A 10% correction happens once per year.

Right now, the S&P 500 is down roughly 5% from its late-October high. That’s not a crisis—that’s Tuesday. It wouldn’t be surprising to see more weakness before strength. Not fun, but expected.

Yet every time markets pull back, we hear the same shit: tough day for the markets huh? You think we are in a bubble? Is this 1999? You see that Michael Burry and Ray Dalio expect a crash?

But what does that even mean, and should you care?

Almost every major economic breakthrough—railroads, automobiles, the internet—came with bubble-like behavior. And bubbles are only confirmed in hindsight. They can run longer and higher than anyone thinks.

Instead of trying to time the exact moment when things go sideways (you won’t be able to nail this regardless), why don’t we start with knowing what you own.

Diversification still matters. Well, maybe not for your neighbor who leveraged his house trying to become a billionaire owning three stocks. Therapy is all that matters for those people.

But if your goal is long-term wealth built with discipline and peace of mind, then spreading your money around makes a ton of sense to me.

Today, many investors are more heavily concentrated in mega-cap tech than they realize: Nvidia, Apple, Alphabet, Oracle, Broadcom. Great companies, yes—but none of these trends last forever. Nvidia just reported another exceptional quarter—revenue up 62% year-over-year, margins were steady, forward guidance was lifted slightly — and yet the stock is down 2% as of this writing. That’s the market for ya.

Humility is a hell of a drug.

Just when you start feeling invincible, the market hands out a quick reality check.

That’s why you need a plan that aligns with your timeline. Someone 15 years from retirement should think very differently than someone five years away. Context matters more than headlines.

Pullbacks aren’t a signal that something is broken. They’re the cost of participating in long-term growth. More money is lost preparing for corrections than in the corrections themselves.

Panics create wonderful buying opportunities for investors with a strong stomach and a long-term horizon.

When you set proper expectations, these periods stop feeling scary—and stop causing you to make changes that are completely unwarranted.

Remember — stay away from investments that you don’t understand conceptually.

I’ve learned to not get angry when others are making money in something I don’t necessarily believe in. I’m a capitalist at heart.

But boy is it hard to root for someone who does this shit…

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.