Why Year-End Price Targets for the S&P 500 Are a Waste of Time

Forecasting is a fool's game; please tune out the noise and focus on long-term strategies...

Every December, top Wall Street firms release their predictions for where they think the S&P 500 will be one year from now.

It’s a popular exercise which typically generates many headlines, but let’s be honest — if you cornered any of these strategists at a bar, even they’d admit this is largely a charade.

Nobody knows where the S&P 500 will be in 12-months.

Still, it’s helpful to get a sense of where the smartest minds see the markets trending over the next 12-months.

For 2024, the general consensus included average growth, lingering recession fears, and debates over valuations (shocker)…

Predictions ranged from cautious optimism to mild pessimism.

Here’s a snapshot of the year-end targets heading into this year, courtesy of Sam Ro:

No surprise. Not a single firm nailed their forecast, 0/10.

Today, the S&P 500 index sits at around 6,050, far exceeding expectations.

Now, let’s take a step back and look at the bigger picture.

On January 4, 2019, the S&P 500 was at 2,531. Over the past five years, the index has more than doubled despite two bear markets (2020 & 2022), a global pandemic, surging inflation, Fed jacked up interest rates, wars, and endless political turmoil…

Incredible, isn’t it?

This highlights a critical point: stop obsessing over short-term forecasts. The S&P 500 has consistently delivered over the long-term, even through chaos and uncertainty.

Sam Ro summed it up perfectly:

⚠️ It’s incredibly difficult to predict with any accuracy where the stock market will be in a year. In addition to the countless number of variables to consider, there are also the totally unpredictable developments that occur along the way.

Strategists will often revise their targets as new information comes in. In fact, some of the numbers you see above represent revisions from prior forecasts.

For most of y’all, it’s probably ill-advised to overhaul your entire investment strategy based on a one-year stock market forecast.

Nevertheless, it can be fun to follow these targets. It helps you get a sense of the various Wall Street firms’ level of bullishness or bearishness.

As we close out the year, the S&P 500 is on track for back-to-back 20%+ annual gains — a rare feat that’s only happened four times in the past 100 years.

These gains may seem like a lot, right? Even seasoned investors are a little weary and are unsure just how long these gains can continue.

But these double-digit moves are more common thank you might think.

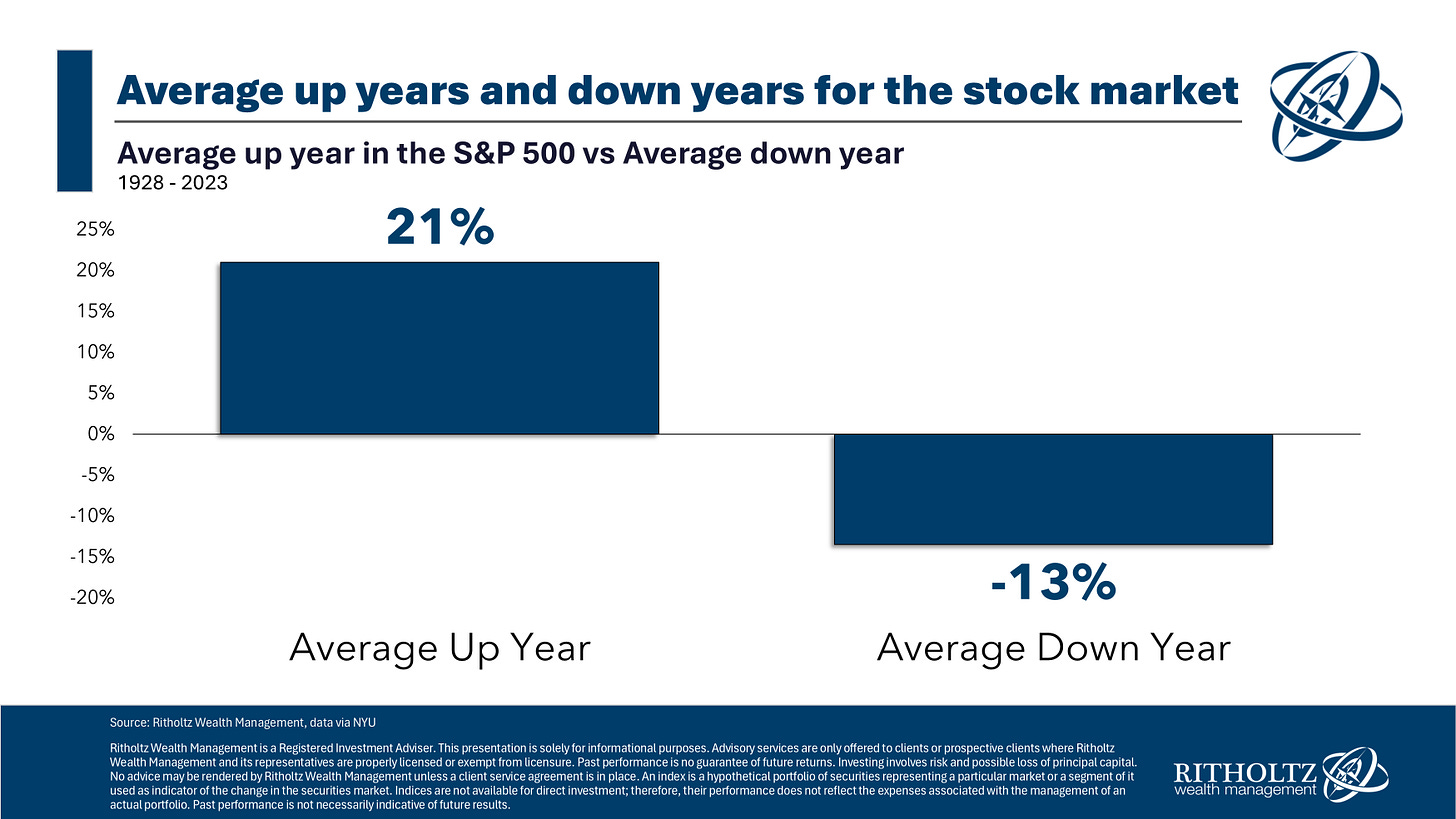

Ben Carlson looked at the average up year for the S&P 500 vs the average down year:

The average gain in an up year for the stock market since 1928 is +21%. The average loss in a down year in that same timeframe was -13%.

Double-digit moves in both directions are the norm. In fact, in 70 of the past 97 years, the U.S. stock market has finished the year with double-digit gains (57x) or double-digit losses (13x).

Remember, we never expect an 8-10% annual return for the stock market. That is just the average.

Heading into the New Year, the big asset managers expect the S&P 500 to rise between 6 - 16%, averaging around 10% (sound familiar?)

With Trump coming back into office, many are expecting deregulation, an extension of the tax cuts, reshoring, and the benefits of AI to start to take shape. This is good news for stocks.

But let’s not kid ourselves: forecasts are meaningless to long-term investors. The market will do what it does — often surprising us all.

Investing success doesn’t come from trying to predict the unpredictable. It comes from staying disciplined, focusing on the long term, and letting compounding do its magic.

Ignore the noise. Stick to your plan. And remember: The S&P 500’s history is a testament to resilience and growth, even in the face of uncertainty.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.