Over the past two years, investors have been getting paid to be conservative. Interest rates hit their highest levels in 20-years and we saw massive inflows into money markets, CDs, Treasury bills, and high-yield savings accounts.

Retail Money Market Inflows From 1/1/2022 - 7/1/2024:

This made a ton of sense for people - try to stop the bleeding they experienced in 2022 and they were able to make 5%+ on their cash without taking on a whole lot of risk.

Also, high-yield savings account almost always pay higher rates than traditional savings accounts which is something to keep in mind…

However, that environment is likely about to change. Jerome Powell was seen on the streets of NYC recently:

Now this isn’t a call to move all of your cash out of these accounts. But it's worth taking a second look, as the rates on money markets, CDs, and high-yield savings accounts are all set to begin their decline.

Here are some key considerations:

Declining Interest Rates Will Lower Returns on Cash Investments

How many of you went to renew a CD only to find out they are offering 5%, but only for 3-months? Or, a 12-month CD now has a 3-handle in front of it? The rates on money markets and HYS accounts are not fixed and they move in tandem with the markets. Expect to receive emails in the coming weeks that HYS rates are coming down and double check what your money markets are paying.

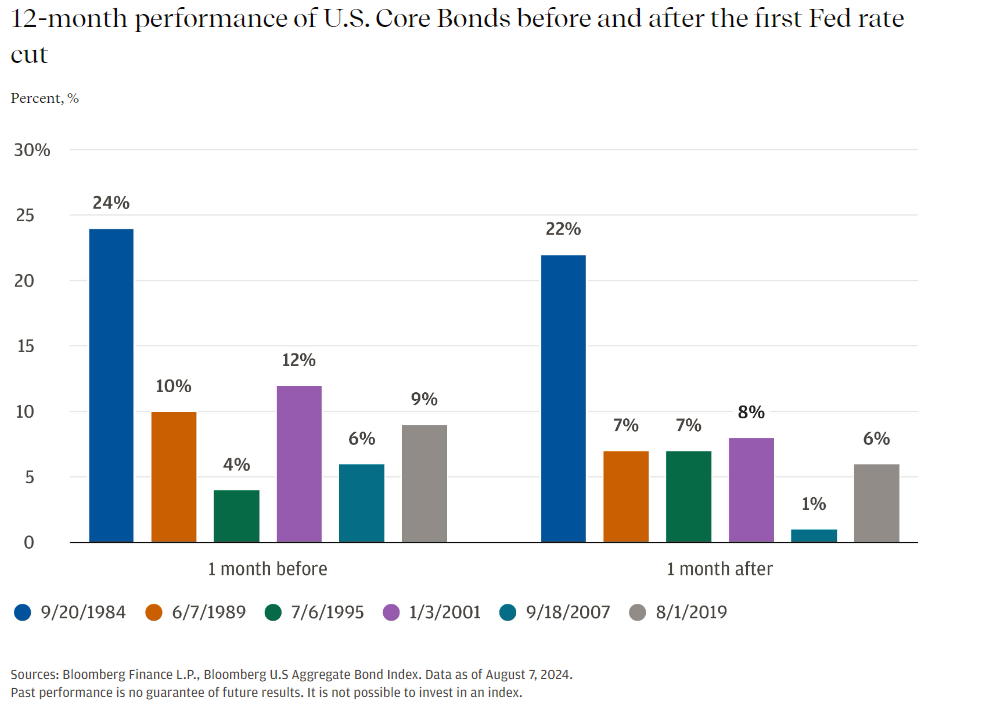

Bonds Are Likely to Outperform Money Markets

When interest rates fall, bond prices generally rise, offering the potential for higher returns. Short-term cash investments, like money markets, don’t see the same price appreciation. Now, it’s getting late to make a big move, but it’s not too late:

Taxes, Taxes, Taxes

The majority of people will be paying higher taxes in 2024. Why? Because many people are now earning more interest from CDs, high yield savings account, and bonds funds, which are taxed at your ordinary income tax rate. Let’s say I’m single and make $150,000/year. All of my income for 2024 above $100,526 is being taxed at 24% at the federal level. So all that interest you are so excited to collect each month, almost 1/4 is going to the government for taxes. Not to mention high earners who are subject to the additional 3.8% net investment income tax. Remember - it’s not how much money you make, but rather how much money you can keep.

Swapping Bonds for Money Market Funds Reduces Portfolio Risk

Although bonds are riskier than money markets on their own, they tend to reduce overall portfolio risk, especially during a recession. Granted this strategy did not work in 2022, when both stocks and bonds fell in tandem… However, bonds can increase in value and offset potential stock losses, whereas cash and money market funds don’t offer this buffer.

For those looking to make a shift, it doesn’t, and frankly shouldn’t be, all-or-nothing. I I personally have become more appreciative of having more cash on hand than usual.

The point here is that we are building a portfolio that can adjust and thrive in all different types of markets.

If you are someone who fell in love with cash over the past two years, now may be a time to reconsider that strategy.

Have questions? Reach out directly.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All rates disclosed above are not 100% accurate and have probably changed.

All investing includes risks, including fluctuating prices and loss of principal.