Q2 2023 Recap

Indices YTD Performance (1/1/23- 6/28/23):

The markets are off to a great start thus far in 2023, especially compared to the first 6-months of 2022, which was one of the worst starts to the year for the S&P 500 dating back to 1970.

Indices YTD Performance (1/1/22- 6/29/22)

The S&P 500 index is now up 22% from its October 12, 2022 closing low.

Keep in the mind the index is still down approximately 9% from its record closing high that it hit in January 2022.

A few reasons why the markets are trending higher: Company profits are once again holding up better than feared (the classic game of underpromising and overdelivering…), sales are increasing around 5% year-over-year, low unemployment, easing inflation, a resilient consumer, and solid GDP data.

Of course there is still plenty to worry about: many still believe that we could get a (mild) recession in late 2023 or early 2024, Q1 was the second consecutive quarter of year-over-year declines in S&P earnings, regional bank stress, commercial real estate challenges, select group of stocks driving most of the gains, U.S.-China tensions, and war in Ukraine. Just to name a few…

But when isn’t there?

Interest Rates:

Current Fed funds rate: 5% to 5.25%.

The Federal Reserve increased their benchmark rate at 10 consecutive meetings, before they finally paused on June 14th.

So, are we finally done with rate hikes?

There was certainly optimism that the Fed was at the end of it’s rate hiking campaign.

But the central bank may be pulling a Lee Corso:

The Fed has been foreshadowing a return to rate hikes next month and I would expect to continue to hear them hammer this idea.

To be determined if this is just an empty threat.

Inflation:

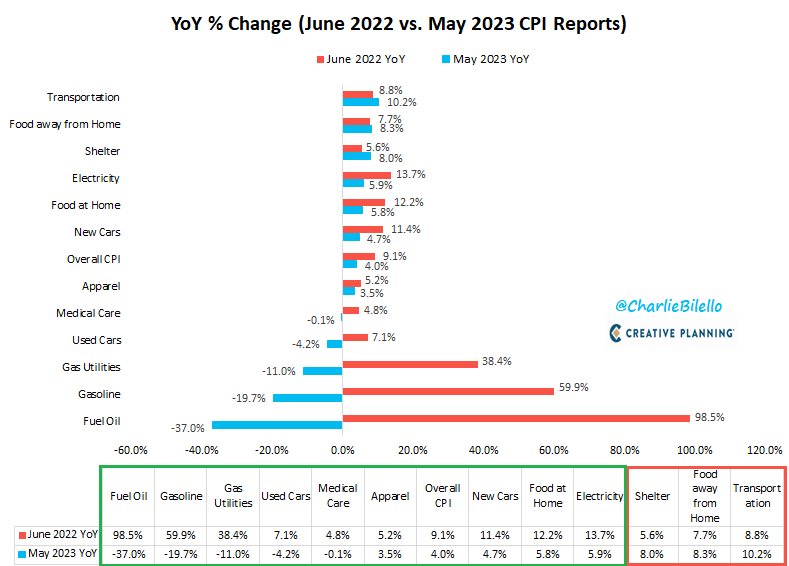

The May CPI report marks the lowest annual inflation reading since March 2021 and continues a downward trend for 11 consecutive months, representing the longest period of deceleration in year-over-year CPI since 1921.

What has been driving the decrease in inflation? Declines in oil/gas, used cars, medical care, apparel, new cars, and food prices:

However, deflationary indicators may persist in the future as corporations tend to find ways to increase profits, often using inflation as a justification to raise prices.

The idea of ‘Price over Volume’ is interesting and could potentially contribute to sustained inflationary pressures across the economy.

Unemployment Rate:

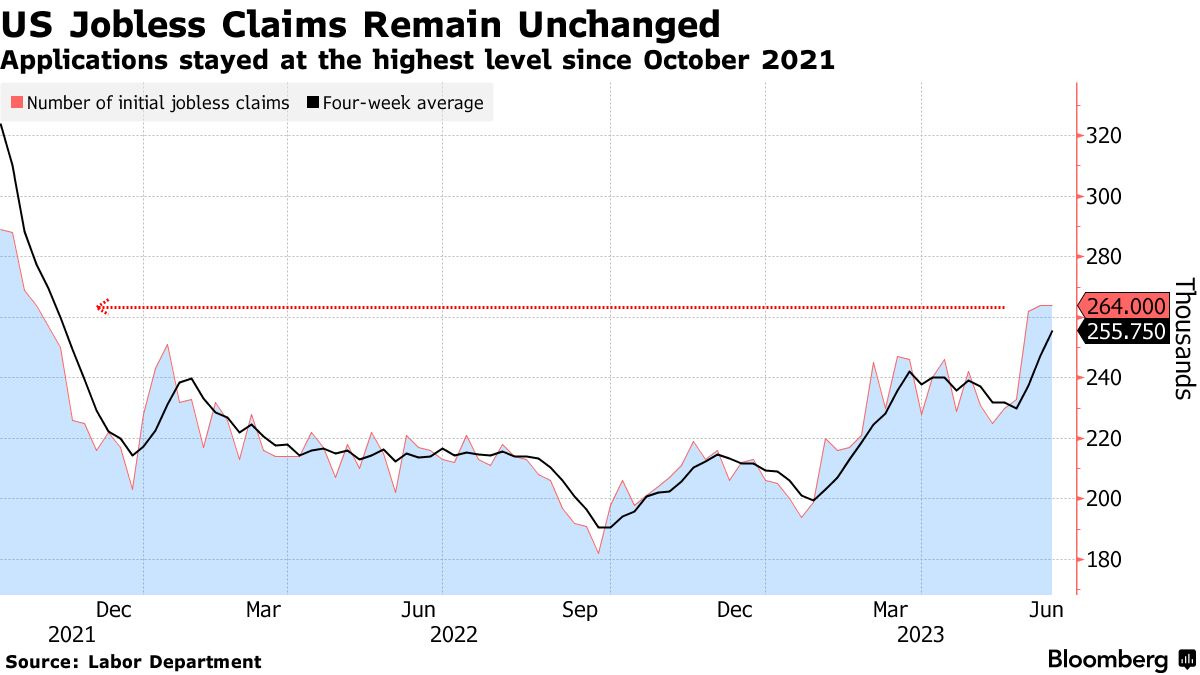

The labor market remains resilient, although we may be seeing some signs of cooling.

Unemployment rate rose to 3.7% in May, compared to April’s 3.4% print:

Jobless claims (those receiving unemployment benefits) has increased through the first six months of the year, hitting its highest level since October 2021:

The good news is the ‘Great Resignation’ seems to be moderating.

Consumer:

Real consumer spending hit another new record in April, adjusted for inflation:

A reminder that consumer spending accounts for 70% of our economy.

Also the top three performers in the S&P 500 index during Q2 was Carnival Corporation, Royal Caribbean, and Norwegian Cruise:

Does this look like a recession to you?

Summary:

As we head towards the second half of the year, the overall trend in the stock market remains positive.

The economy and labor market have remained resilient, corporate earnings are strong, we are closer to the end then the beginning of the Fed tightening cycle, the third year of the presidential cycle tends to be a positive catalyst for the markets, and the fact that strong starts to a year tend to be followed by strong finishes:

While we might experience some bumps along the way, it's important to keep our long-term perspective intact and stay focused on quality investments.

Should we experience some volatility, try and seize the opportunities that arise during market pullbacks.

Remember, volatility creates opportunities for those who can stay calm and make rational decisions.

It's crucial to have a well-diversified portfolio that can weather the storm and stay invested for the long haul.

So, let's buckle up and see what the second half of 2023 has in store for us…

Further Reading:

A Recession is Coming! So What...

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

All investing includes risks, including fluctuating prices and loss of principal.