Q3 2022 Recap

Indices YTD Performance (1/1/22- 9/30/22)

If there was one word to summarize the first nine months of the year as an investor, it would be ‘painful’.

The S&P 500 is down 25% through the first 188 trading days, making this the 4th worst start to a year in history.

Not only has the decline been painful to endure, but it’s also the volatility that has investors exhausted. Through September 30th, the S&P 500 declined by 1% or more 50 times this year, the most since 2009.

Many expected inflation to decline during the quarter as oil prices came down 40% from their March highs. But it’s become more wide spread as housing, food, and medical costs far outweighed the decline in gasoline prices.

Investors now expect the Fed and central banks around the globe to continue raising rates in lockstep, with the exception of a few countries. As a reminder, rising interest rates negatively effect stock valuations, bond prices, and reduces economic activity as it’s more expensive to borrow money.

It takes time for the interest rate increases to make its way through the economy. A lot of these measures show lagging results so some people are concerned that the Fed may overdo the rate hikes as they try and improve their credibility.

We are already starting to see the impacts of high interest rates:

30-year mortgage rate climbs to near 7% and home prices are down roughly 6% from their June highs.

The initial public offering (IPO) market has dried up considerably as investors reduce their exposure to risk assets and preserve their cash:

Consumers try and stay away from taking out high interest rate loans and dip into their bank accounts. A record $370 billion of bank deposits were taken out in Q2 as investors sought higher yields in Government bonds (Treasury bills, I Bonds, etc.)

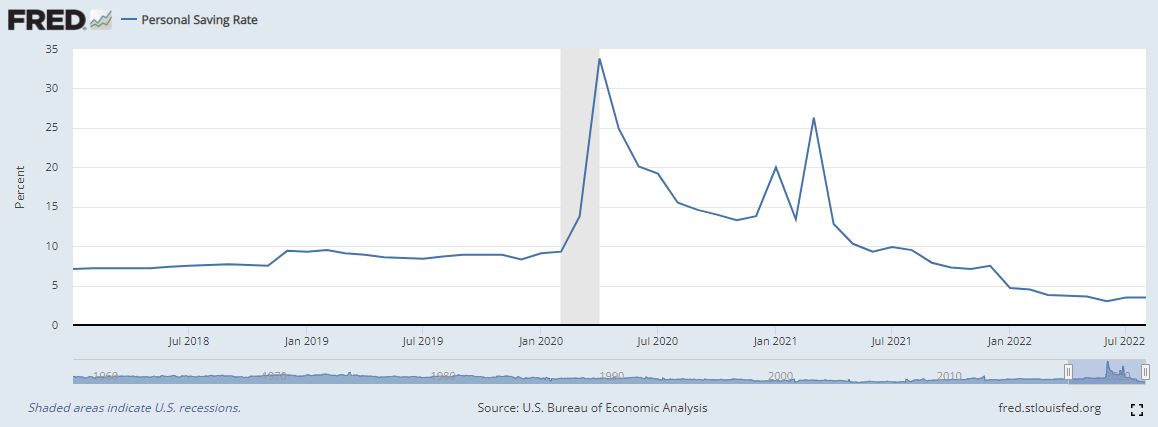

Inflation continues to eat away at household budgets as the US savings rate continues to moderate:

Walmart made comments at the end of July, as they trimmed their profit forecasts, that individuals are spending more on fuel and groceries so less of their income is going towards accessories and clothing.

Supply chains are still out of whack, as Nike recently noted that they are trying to clear excess inventory levels.

Despite the consistent negative headlines, we are seeing some glimmers of hope that inflation could come down:

Home prices in July still higher Year-over-Year (YoY), but down 2.3% month over month. Might not seem like much but this is the largest deceleration in the history of the index.

Crude Oil down 40% from March high.

Used car prices down 13% YTD.

Global freight rates down 57% YTD. Nike also made this comment: “…transit times began to rapidly improve, with signals that further improvement may be coming.”

Rents down in September, 1st decline this year (YoY% increase at lowest level since May 2021).

Some other points to consider:

Profits have handily outpaced costs for companies as corporate profit margins jumped to highest level since 1950 in Q2. With the upcoming Q3 earnings season, we will get a better glimpse at how companies are holding up…

Despite the Feds wishes, the US economy is still adding jobs and while we saw the unemployment rate slightly increase, it is still relatively low.

Q4 tends to be the best quarter during a mid-term year as we get some clarity from the elections:

Although this has been the fourth worst start to the year, Q4 has historically provided a slight bounce to the upside, which the exception of 2008:

The investment journey for everyone is different. But this is a year where most are taking it on the chin, even bond holders (remember when those were considered safe?).

But this storm too shall pass. I don’t know when, but it will.

We’ve been told that the S&P 500 has returned 10% per year on average. Seems easy enough right?

But did you know that only seven of the last 96 years has the S&P 500 return ended up between 8% - 12%?1

Meaning that there will be years where we are up 26%, 16%, 29%. But then there will be years where we see the 23%, 13%, and 16% declines.

Since 1970, the S&P 500 has been cut in half on three separate occasions.

If we are dead set on tracking the stock market on a daily, or even yearly basis, we mine as well reopen the closed psychiatric and insane asylums from the 19th century.

The media is having a field day with all of these ‘doomsday’ scenarios. I’ve heard from many that, “but this has never happened before!”

But Professor Scott Sagan put it best, “Things that have never happened before, happen all the time.”

The noise shouldn’t be as loud for goal-focused, long-term, plan driven investors.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

According to Nick Murray’s September 2022 Newsletter